- 3 Big Scoops

- Posts

- 🗞 Big Tech Outspends Big Oil

🗞 Big Tech Outspends Big Oil

+five other mind-blowing charts

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,918.25 ( ⬆️ 0.16%)

Nasdaq Composite @ 19,478.88 ( ⬇️ 0.055%)

Bitcoin @ 93,800.17 ( ⬇️ 2.9%)

Hey Scoopers,

Welcome to today's special edition, where we break down some JUICY insights from Morgan Stanley's latest report, "Charts From the Vault."

Let's dive into what the Wall Street brainiacs discovered!

There’s a reason 400,000 professionals read this daily.

Join The AI Report, trusted by 400,000+ professionals at Google, Microsoft, and OpenAI. Get daily insights, tools, and strategies to master practical AI skills that drive results.

🏦 THE BIG PICTURE INSIGHTS:

Buffett’s Favorite Metric is Screaming

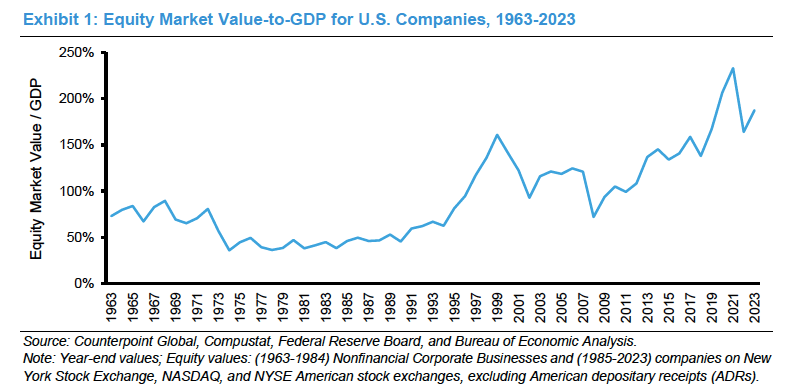

The ratio of market value to GDP (Warren Buffett’s fav indicator) hit 233% in 2021

That's WILD, considering it was “only” 160% during the dot-com bubble

It's cooled to 187% in 2023 thanks to some post-COVID normalization but remains high given historical levels.

Big Tech = Capital Monsters

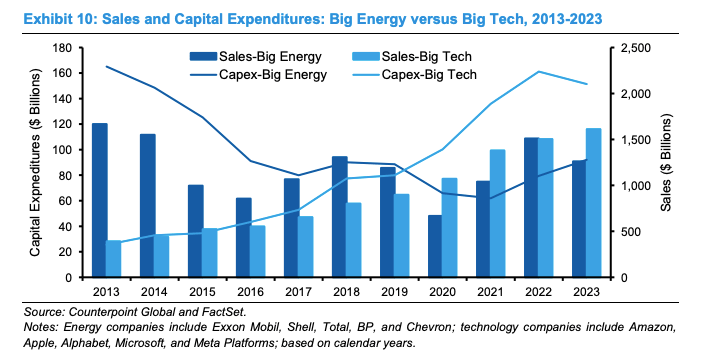

Plot twist: Big Tech now spends MORE on capital expenditure than Big Oil

In 2013, energy companies spent 6.5x more than tech companies

By 2022, tech companies were spending DOUBLE what energy companies spend

Cloud computing and AI are expensive toys, folks!

The Magnificent 7 Are Dominating

Top 10 stocks went from 14% of total market cap in 2014 to 27% in 2023 and almost 40% in 2024

Active fund managers who bet big on these mega-caps crushed it in 2023 and 2024

Those who didn't... well, let's say they had a rough year 😅

The IPO Myth Gets Busted

Everyone thinks companies have terrible returns right after an IPO

WRONG! Data shows they have their best ROIC-WACC spread at IPO

It drops after year 3 (probably when the founders start buying yachts)

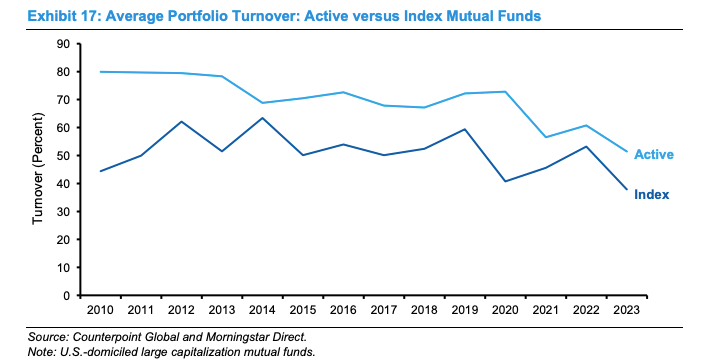

Mutual Funds are Playing the Long Game

Everyone says fund managers are getting more short-term focused

The data says NOPE! Average turnover has DECREASED since 2010

Current holding period: about 3 years (longer than you'd think!)

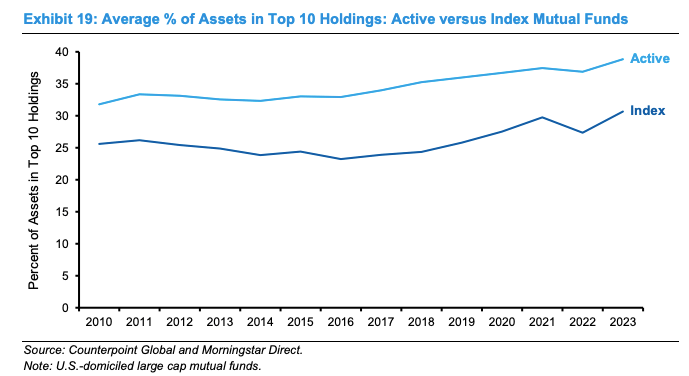

Is Concentration the New Normal?

Active funds now hold 39% of assets in their top 10 positions

Index funds? Only 31% in their top 10

Plot twist: Active managers are more concentrated than passive ones!

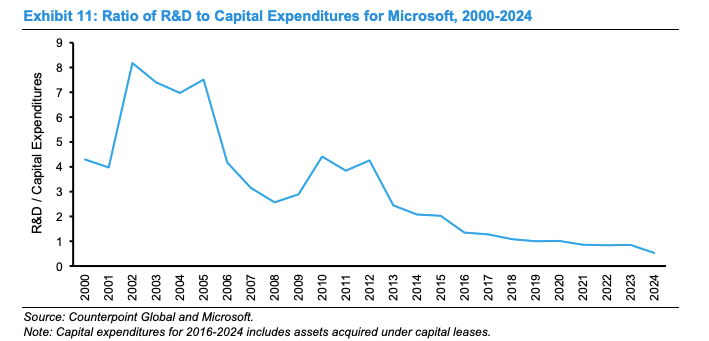

The Digital Transformation is Real

Microsoft's R&D-to-capex ratio dropped from 8.2x in 2002 to 0.5x in 2024

Translation: They're spending WAY more on physical infrastructure

Why? Because cloud computing needs actual buildings, not just code bros!

Intangible Assets are the New Gold

In 1975: Physical assets were 2x intangible assets

By 2025: It's expected to flip completely

Software is eating the world!

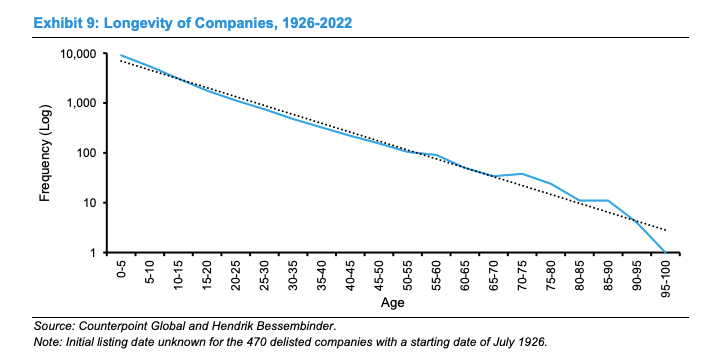

Survival of the Fittest is Real

60% of public companies "die" through M&A

Companies need to adapt or get acquired

It's giving "corporate Red Queen hypothesis" vibes

The Index Fund Revolution

Index funds now own about 33.5% of all assets

But plot twist: they're not as passive as you think

Still lots of action under the hood

Energy vs. Tech: The Great FLIP?

Tech companies used to be asset-light

Now they're building more physical infra than energy companies

AI and cloud need actual hardware - who knew?

Is GDP understated?

Traditional GDP measures miss a lot of digital value

It makes historical comparisons tricky

We might be richer than we think!

The Future? Concentrated

The market is getting more concentrated, but...

U.S. is still less concentrated than other major markets

Sometimes bigger is better

🔥 FINAL THOUGHTS

This report says everything is getting bigger, more concentrated, and more digital. The old rules are changing, and the most prominent players are winning more than ever.

That's all for today, fam!

Drop a 🏦 if you learned something new!

See ya tomorrow with more alpha!

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.