- 3 Big Scoops

- Posts

- 🗞 Berkshire Trims Apple Stake

🗞 Berkshire Trims Apple Stake

while Nvidia joins the Dow

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

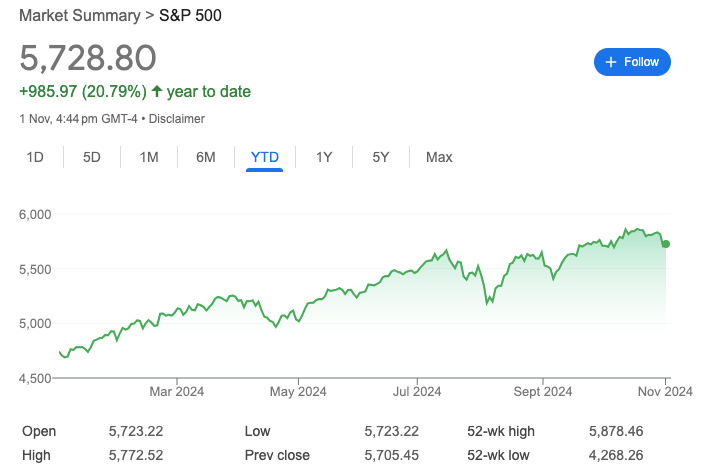

S&P 500 @ 5,728.80 ( ⬆️ 0.41%)

Nasdaq Composite @ 18,239.92 ( ⬇️ 0.80%)

Bitcoin @ $68,064.04 ( ⬇️ 2.01%)

Hey Scoopers,

Happy Monday! Are you ready for an exciting newsletter today?

👉 Berkshire Hathaway’s cash pile fattens

👉 Google Cloud gains traction

👉 Nvidia replaces Intel in the Dow

So, let’s go 🚀

Market Wrap

Stocks rallied on Friday to kick off November as Amazon led big technology stocks into the green and traders looked past a disappointing jobs report.

Amazon surged over 6% as its strength in the cloud and advertising businesses propelled the e-commerce giant to surpass consensus estimates.

Meanwhile, the jobs report released on Friday showed the U.S. economy added just 12,000 jobs last month, much below estimates of 100,000.

It marked the weakest level of job creation since December 2020, while the unemployment rate remained at 4.1%, in line with estimates.

However, traders were not reacting too much to the jobs figures, believing hurricanes and a Boeing strike impacted the data.

Trending Stocks 🔥

Cardinal Health - The healthcare services provider gained 7%, hitting a fresh 52-week high after it reported earnings of $1.88 per share with revenue of $52.28 billion, compared to estimates of $1.62 per share and $50.9 billion respectively.

Intel - Shares popped 7.8% after the chipmaker reported revenue of $13.3 billion with adjusted earnings of $0.17 per share, both of which beat estimates.

Boeing - Shares gained 3.4% after the plane maker agreed to a new negotiated contract with its machinists’ union to end a seven-week-long strike, which includes a pay increase of 38% over the next four years, up from a previous offer of 35%.

Berkshire Hathaway Remains Cautious

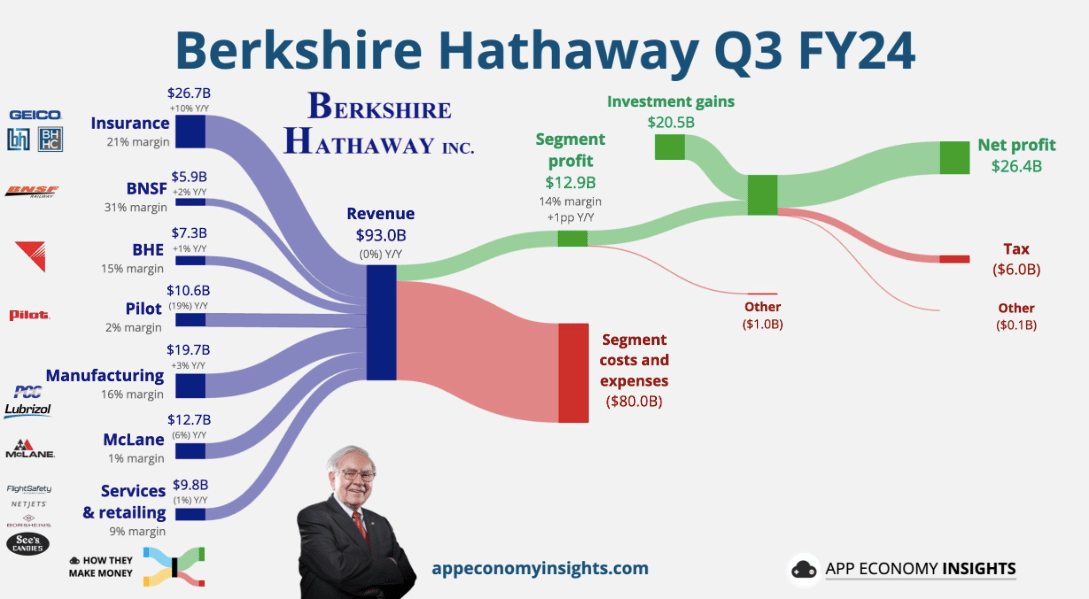

Berkshire Hathaway ended Q3 of 2024 with a record cash pile of $325.2 billion, up from $276.9 billion in Q2, as Warren Buffett continued his stock-selling spree and held back from repurchasing shares.

The financial giant’s cash balance grew as the Oracle of Omaha sold positions in Apple and Bank of America. In fact, Berkshire dumped around 25% of its stake in Apple, making it the fourth consecutive quarter where it downsized this bet.

The company also offloaded $10 billion in Bank of America in the September quarter. Overall, Berkshire reduced its equity position by $36.1 billion in Q3.

The Omaha-based conglomerate held close to $70 billion worth of Apple shares at the end of Q3, implying it sold a quarter of this stake in the hardware heavyweight.

Buffett started trimming his stake in the iPhone maker in Q4 of 2023 and ramped up selling in Q2 when he dumped half of the investment. The Wall Street mogul fell in love with Apple for its loyal customer base, the stickiness of the iPhone, and an expanding ecosystem.

Meanwhile, Berkshire reported an operating income of $10.1 billion in Q3, down 6% year over year due to weak insurance underwriting.

Buffett’s conservative posture comes as the stock market trades near all-time highs due to cooling inflation and falling interest rates.

Nvidia Replaces Intel

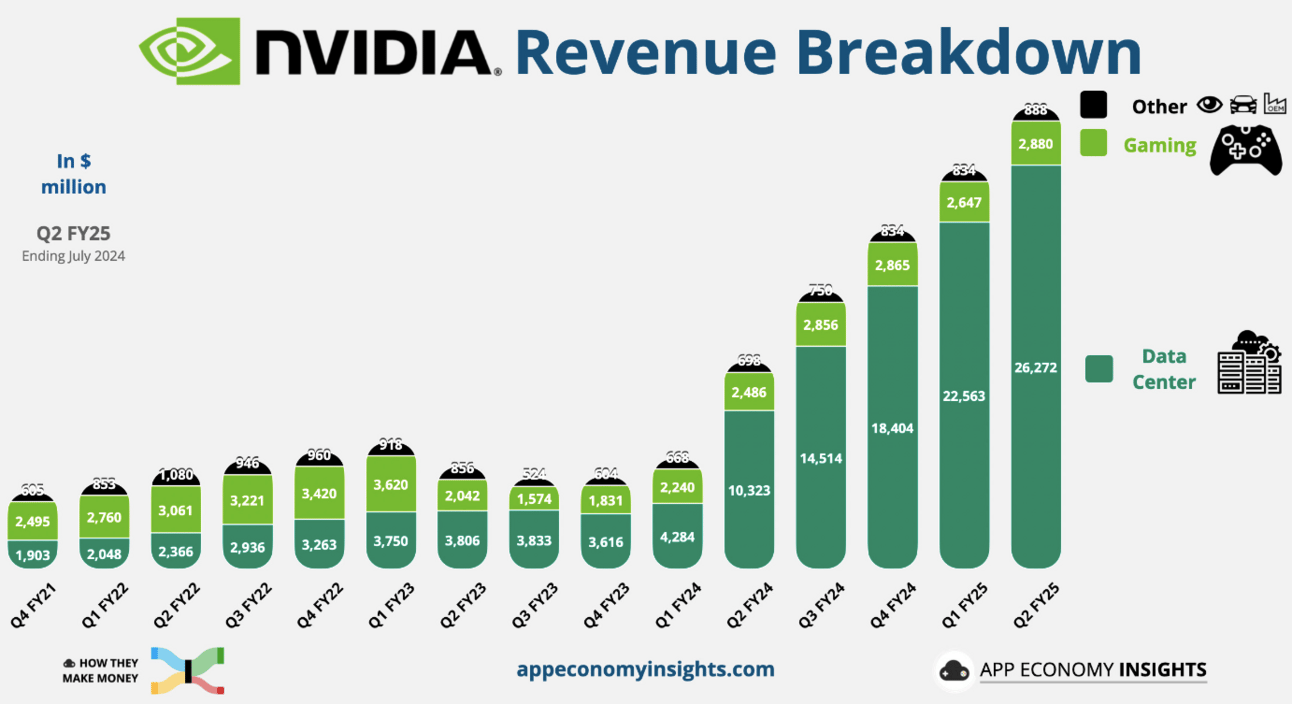

Nvidia is replacing rival chipmaker Intel in the Dow Jones Industrial Average, a shake-up to the blue-chip index, reflecting the boom in artificial intelligence and a major shift in the semiconductor industry. The switch in the index will take place on Nov. 8.

Nvidia stock is up 170% year-to-date after surging 240% last year, as investors remain bullish on the AI chipmaker. With a market cap of $3.3 trillion, Nvidia is now the second-largest company in the world.

Big tech companies such as Microsoft, Meta, Google, and Amazon are purchasing Nvidia’s GPUs or graphics processing units to build clusters of computers and gain a foothold in the AI race.

Nvidia’s revenue has more than doubled in the last five quarters and has at least tripled in three of them.

Comparatively, Intel stock is down over 50% in 2024 as it continues to struggle with manufacturing challenges and competition for its central processors.

Intel has focused on cost and capital reduction activities to offset falling sales and profit margins, including reducing its headcount by 16,500 employees and its real estate footprint.

Google Cloud Growth Gains Pace

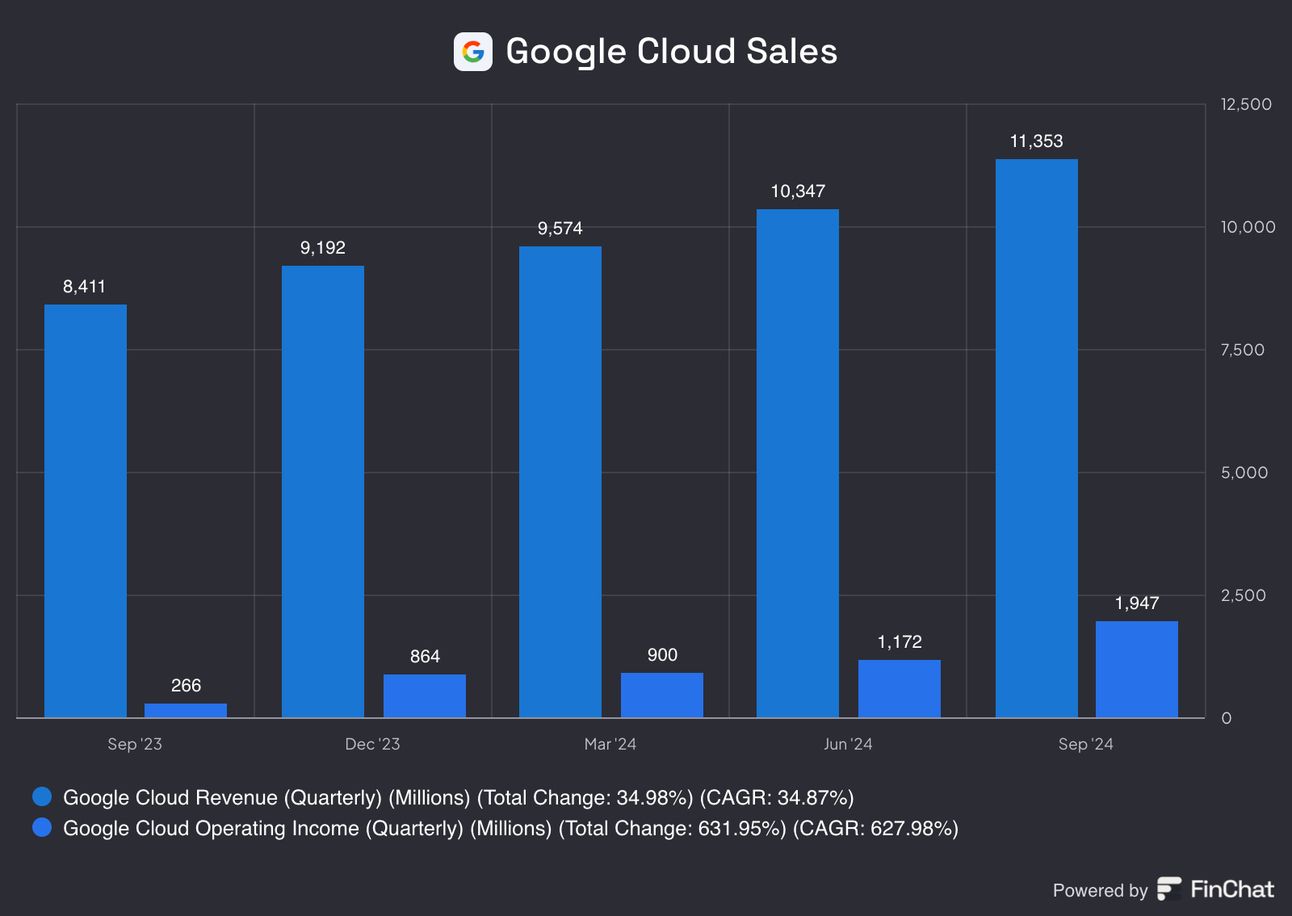

Google outpaced its rivals within the cloud segment, a sign that the internet company is gaining traction in artificial intelligence.

Google’s cloud segment rose by 35% year over year in Q3 of 2024 to $11.35 billion, accelerating from 29% in the prior period.

Amazon Web Services, the market leader, grew 19% to $27.45 billion, more than twice the size of Google Cloud but expanding about half as quickly. In second place is Microsoft, which grew its cloud sales by 33% in the last quarter.

In Q3, Google Cloud reported an operating margin of 17% after first turning profitable last year. Comparatively, AWS reported an operating margin of 38% and is a cash cow for Amazon.

Oracle is another major player among cloud infrastructure companies. In its last report, Oracle emphasized cloud infrastructure sales jumped 45% to $2.2 billion, up from 42% growth in the prior quarter.

Looking for unbiased, fact-based news? Join 1440 today.

Upgrade your news intake with 1440! Dive into a daily newsletter trusted by millions for its comprehensive, 5-minute snapshot of the world's happenings. We navigate through over 100 sources to bring you fact-based news on politics, business, and culture—minus the bias and absolutely free.

Headlines You Can't Miss!

Affirm expands to the U.K.

China awaits stimulus details

What will power AI platforms?

China’s singles day event just got done

Crypto M&A deals are on the rise

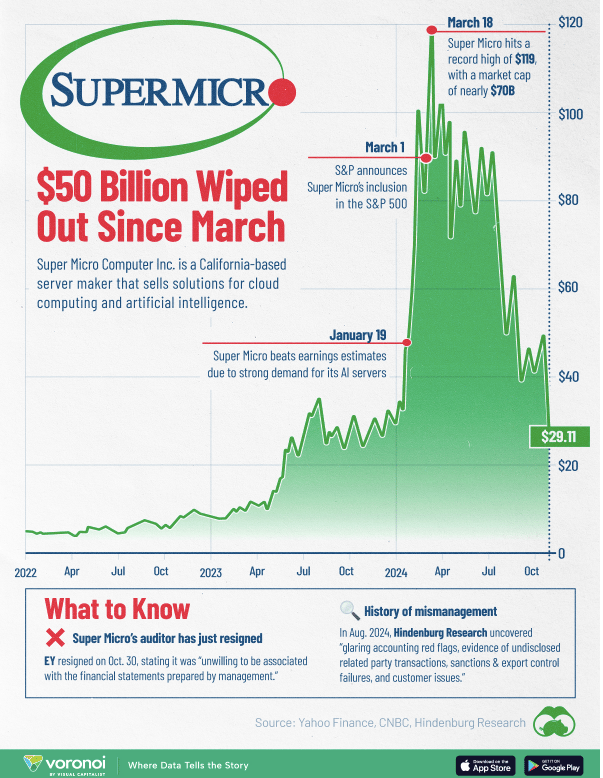

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.