- 3 Big Scoops

- Posts

- 🗞 Berkshire's Cash Pile Rises in Q4

🗞 Berkshire's Cash Pile Rises in Q4

PLUS: Tesla enters India

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

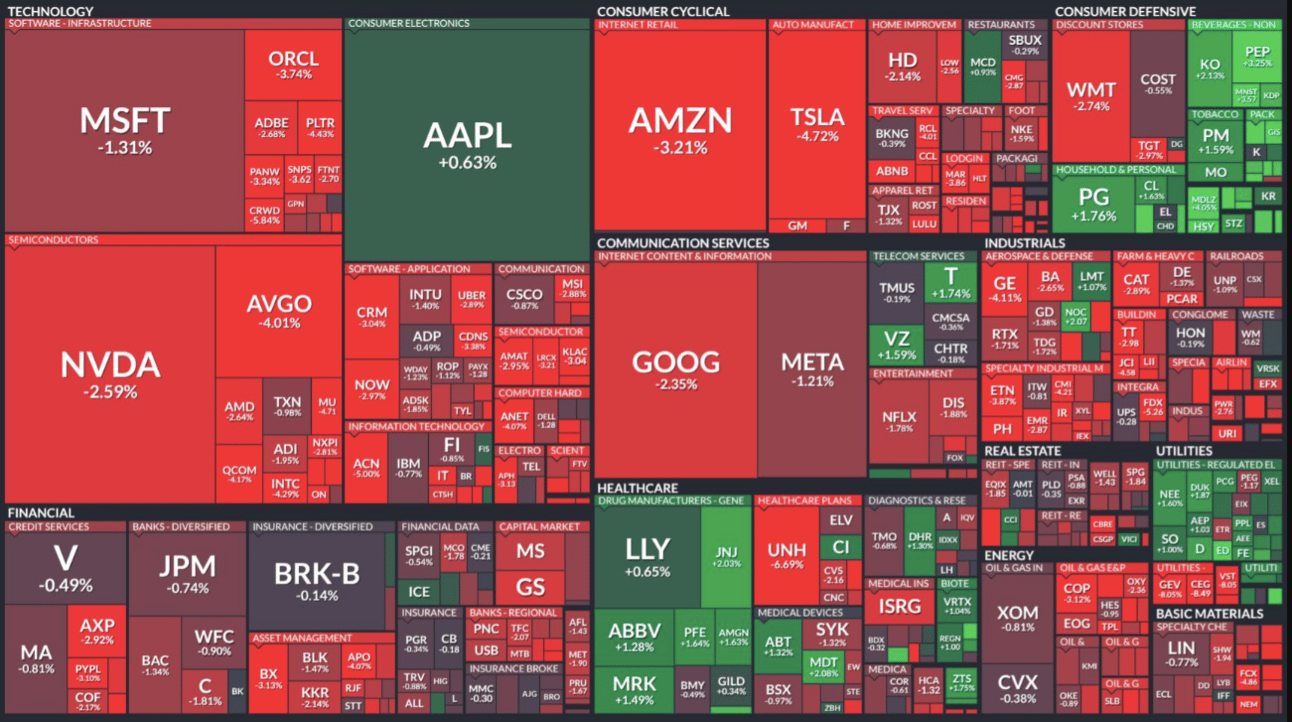

S&P 500 @ 6,013.13 ( ⬇️ 1.71%)

Nasdaq Composite @ 19,524.01 ( ⬇️ 2.20%)

Bitcoin @ $96,298.88 ( ⬇️ 2.12%)

Hey Scoopers,

Happy Monday! Here’s what we’re covering today 👇

👉 Berkshire’s operating income surges in Q4

👉 Tesla eyes India expansion

👉 International growth key for S&P 500 earnings

So, let’s go 🚀

Market Wrap

Stocks tumbled Friday as fresh economic data ignited concerns about slowing growth and persistent inflation, prompting investors to seek safer assets.

The Dow Jones Industrial Average plunged 748.63 points, or 1.69%, to 43,428.02, marking its worst decline of 2025.

The S&P 500 fell 1.71% to 6,013.13, retreating from Wednesday's record close, while the Nasdaq Composite dropped 2.2% to 19,524.01.

The selloff intensified late in the session as traders reduced their exposure before the weekend.

Wall Street was wary of potential market-moving headlines from the Trump administration, which has announced several major policy shifts in its first month.

Key economic data fueled the decline:

University of Michigan's consumer sentiment dropped sharply to 64.7

Five-year inflation expectations hit 3.5%, the highest since 1995

Existing home sales fell more than expected to 4.08 million units

U.S. services PMI entered contraction territory

Notable investor Steve Cohen warned of a possible "significant correction," citing Trump's proposed tariffs and government cost-cutting measures.

Defensive sectors led the day's gains, with consumer staples like Procter & Gamble, General Mills, and Kraft Heinz advancing.

Tech favorites Nvidia and Palantir saw steep losses. The S&P 500 declined 1.7% for the week, while the Dow and Nasdaq lost 2.5%.

The AI Stock Poised to Soar Under Trump’s $500B Plan

Nvidia was a standout opportunity back in February 2019, delivering a massive 490% return.

Now, there's another under-the-radar AI stock, 2,500x smaller than Nvidia, with significant potential. And with Trump’s recent $500 billion AI push, the timing couldn’t be better.

Trending Stocks 🔥

Celsius Holdings - The energy drink company gained over 27% after reporting adjusted earnings of $0.14 per share and revenue of $332 million in Q4, compared to estimates of $0.11 per share and $326 million, respectively.

Dropbox - The cloud storage stock fell 16% after it reported an adjusted gross margin of 83.1% in Q4, in line with estimates.

Block - The fintech stock dipped 17% after missing consensus revenue and earnings estimates in Q4 of 2024.

Warren Buffett Remains Cautious on Valuations

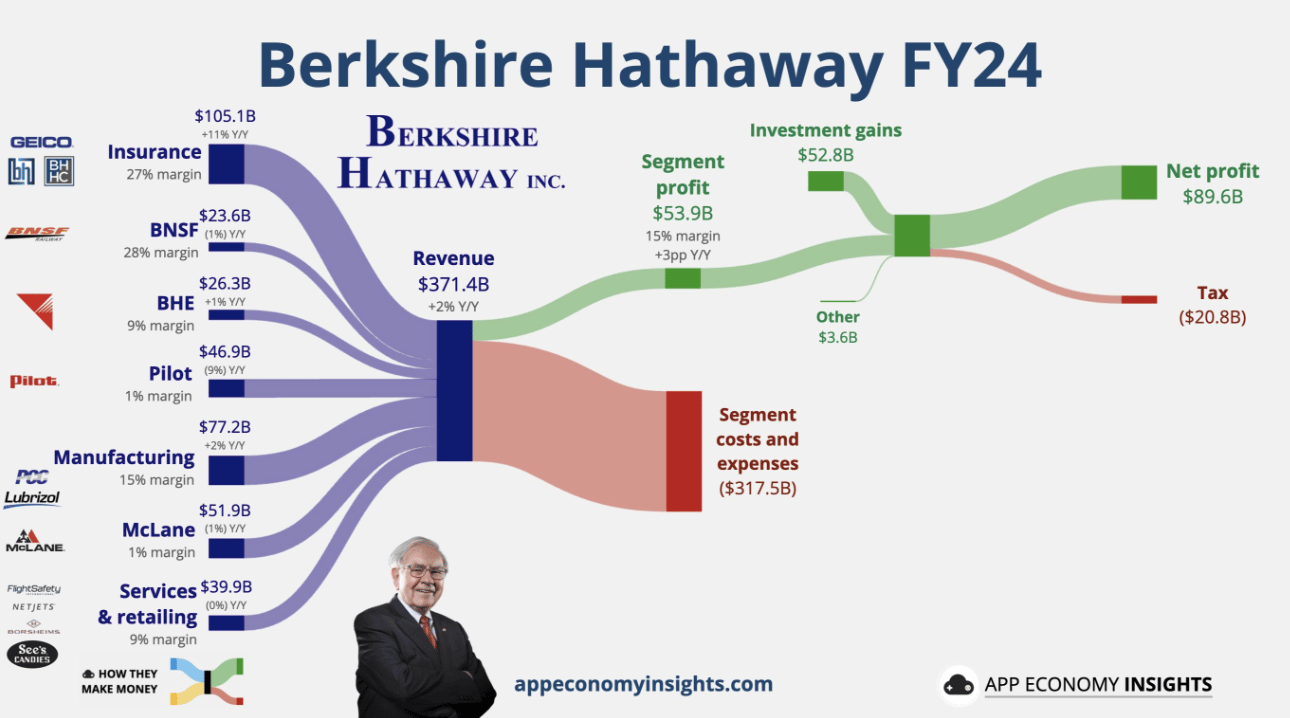

Berkshire Hathaway reported a surge in fourth-quarter operating earnings, driven by strong insurance performance, while its cash pile hit a new record of $334.2 billion.

The Warren Buffett-led conglomerate saw operating earnings — which reflect profits from wholly owned businesses — soar 71% to $14.52 billion in Q4.

Key performance highlights include:

Insurance underwriting profits jumped 302% to $3.41 billion

Insurance investment income rose nearly 50% to $4.08 billion

Full-year operating earnings increased 27% to $47.43 billion

However, Berkshire warned that recent Southern California wildfires could result in a $1.3 billion pre-tax insurance loss.

Buffett defended Berkshire’s growing cash position in his annual letter, emphasizing that "the great majority of our money remains in equities."

The company's marketable equity portfolio decreased from $354 billion to $272 billion in 2024, though Buffett noted the value of non-quoted controlled equities increased.

Investment gains slowed significantly in Q4 to $5.16 billion, down from $29.09 billion a year earlier, as Berkshire trimmed its stock investments, including reducing its Apple stake.

Total earnings for the quarter fell 47% to $19.694 billion, while full-year earnings declined 7.5% to $88.995 billion.

International Sales Might Boost Q4 Earnings

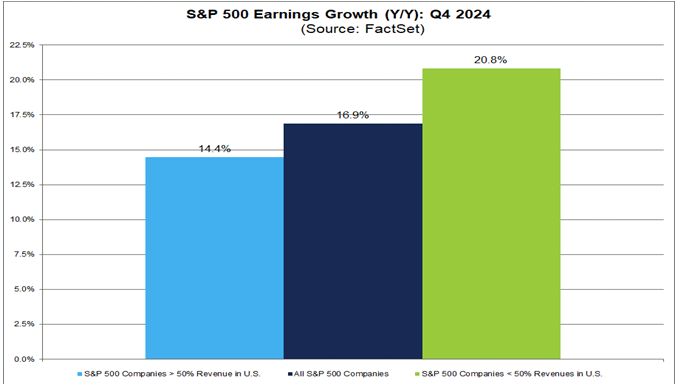

According to a new FactSet analysis, despite a stronger U.S. dollar in the fourth quarter, S&P 500 companies with significant international exposure outperformed their domestically focused counterparts.

The U.S. Dollar Index climbed 7.6% during Q4, reaching 108.49. However, companies generating over 50% of sales internationally posted earnings growth of 20.8%, substantially beating the 14.4% growth reported by primarily domestic businesses.

Revenue growth showed a similar pattern, with international companies growing 5.9% versus 5.0% for domestic firms.

The outperformance was largely driven by:

Communication Services and Information Technology sectors leading international growth

Nvidia is emerging as the top contributor to international earnings

Energy and Industrials sectors dragging on domestic performance

Boeing weighing heavily on domestic earnings

However, the tide appears to be turning. Looking ahead to Q1 of 2025, companies with greater international exposure are projected to see lower earnings growth of 6.6%, while domestically-focused firms are expected to grow earnings by 9.1%.

The overall S&P 500 posted blended earnings growth of 16.9% for Q4 2024, with revenue growth of 5.2%.

Tesla Enters India

Tesla is making a major push into India, securing prime showroom locations and launching a significant hiring initiative as the electric vehicle maker prepares to enter one of the world's largest automotive markets.

The EV giant has leased approximately 5,000 square feet in New Delhi's Aerocity and Mumbai's Bandra Kurla Complex, positioning itself in key commercial districts near both cities' airports.

Tesla has posted 13 mid-level positions across both locations, including roles for service technicians, customer engagement managers, and operations specialists.

These developments follow a recent meeting between CEO Elon Musk and Indian Prime Minister Narendra Modi. India has also reduced import duties on premium vehicles from 110% to 70%.

Tesla plans to begin with imported vehicle sales by April 2025, starting with an EV priced around ₹21 lakh ($25,300). Key aspects of Tesla’s India strategy include:

Initial focus on imported vehicles to assess market demand

Potential manufacturing site near Pune, Maharashtra

Gradual expansion approach to minimize investment risks

The move is expected to transform India's automotive landscape, where the government aims for 30% of vehicle sales to be electric by 2030.

Industry analysts say Tesla's entry could accelerate EV adoption and drive innovation among local manufacturers.

Headlines You Can't Miss!

Hooters to file for bankruptcy

Rivian reports a positive gross profit in Q4

Will Tesla invest in Nissan?

X seeks to raise money at a $44 billion valuation

ByBit loses $1.5 billion to crypto hack

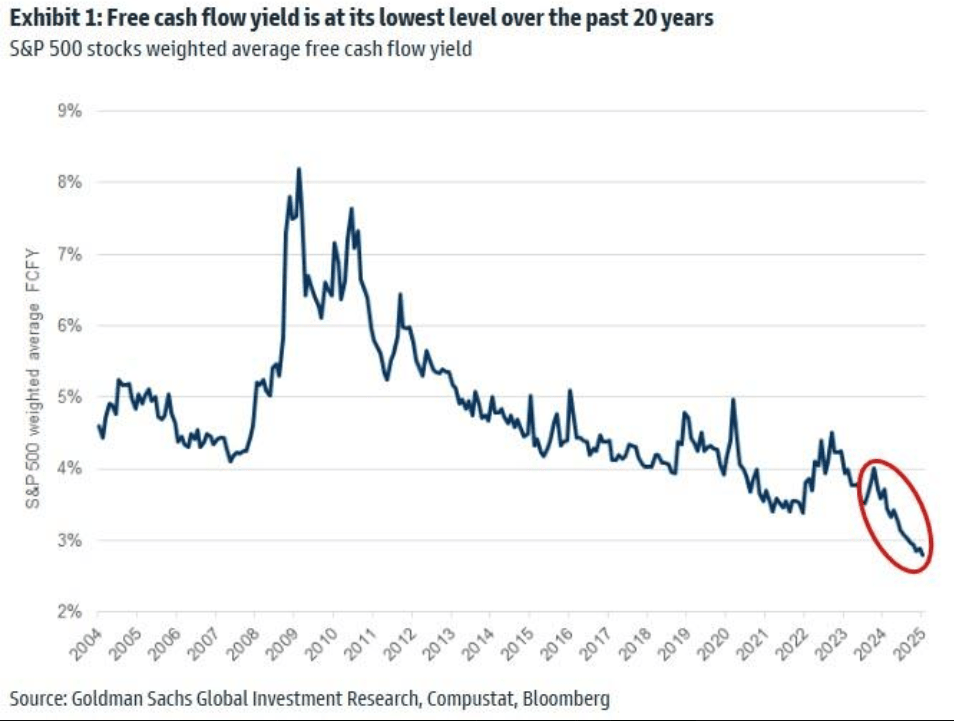

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.