- 3 Big Scoops

- Posts

- 🗞 Bear Market Incoming?

🗞 Bear Market Incoming?

PLUS: Big tech lose over $2 trillion

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,074.08 ( ⬇️ 5.97%)

Nasdaq Composite @ 15,587.79 ( ⬇️ 5.82%)

Bitcoin @ $76,721 ( ⬇️ 8.21%)

Hey Scoopers,

Happy Monday! Here’s what we’re covering today:

👉 Chaos grips Wall Street

👉 Tesla leads Big Tech sell-off

👉 Should you buy the dip?

So, let’s go 🚀

Market Wrap

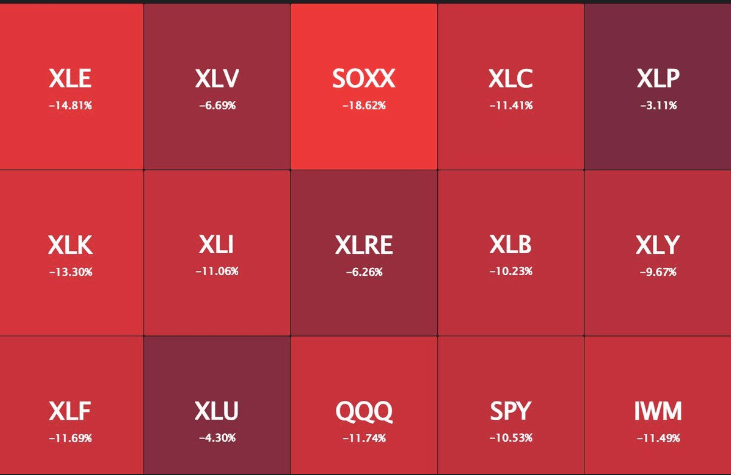

Wall Street suffered its worst week since the early days of the COVID-19 pandemic as escalating trade tensions between the U.S. and China sparked a global market selloff.

The Dow Jones Industrial Average plunged 5.5% on Friday, following Thursday's steep decline. This marked the first time the Dow shed more than 1,500 points on consecutive days.

The S&P 500 nosedived 6% to 5,074.08, while the tech-heavy Nasdaq Composite tumbled 5.8%, officially entering bear market territory – down 22% from its December peak.

China's announcement of a 34% levy on all US products heightened fears of a full-blown trade war.

Beijing also added several US companies to its "unreliable entities list" and launched an antitrust investigation into DuPont, causing its shares to plummet nearly 13%.

"The bull market is dead, and it was destroyed by ideologues and self-inflicted wounds," said Emily Bowersock Hill, CEO of Bowersock Capital Partners.

Semiconductor stocks were particularly hard hit, with related ETFs posting their worst weekly performance in years as investors sought safety in bonds, pushing the 10-year Treasury yield below 4%.

Crypto’s Most Influential Event

Consensus is the world’s longest-running gathering of the global crypto, blockchain, and AI communities.

Celebrated as ‘The Super Bowl of Blockchain’, Consensus will welcome 20,000 attendees shaping the decentralized digital economy to Toronto this May 14-16.

Ready to invest in your future?

Attending is your best bet.

Trending Stocks 🔥

Bank Stock - Bank stocks like Goldman Sachs, Citigroup, Morgan Stanley, and Wells Fargo retreated as new tariff policies raised fears of a U.S. economic pullback.

Tesla, Palantir - Top picks among retail investors could not buck Friday’s sell-off. Electric vehicle maker Tesla dropped around 10%, while defense technology stock Palantir tumbled 11.5%.

Property stocks - Real estate stocks Prologis and Simon Property Group each slipped about 3% on Friday. Property stocks are sensitive to consumers’ discretionary spending levels.

Tech Giants Bear Brunt of Market Selloff

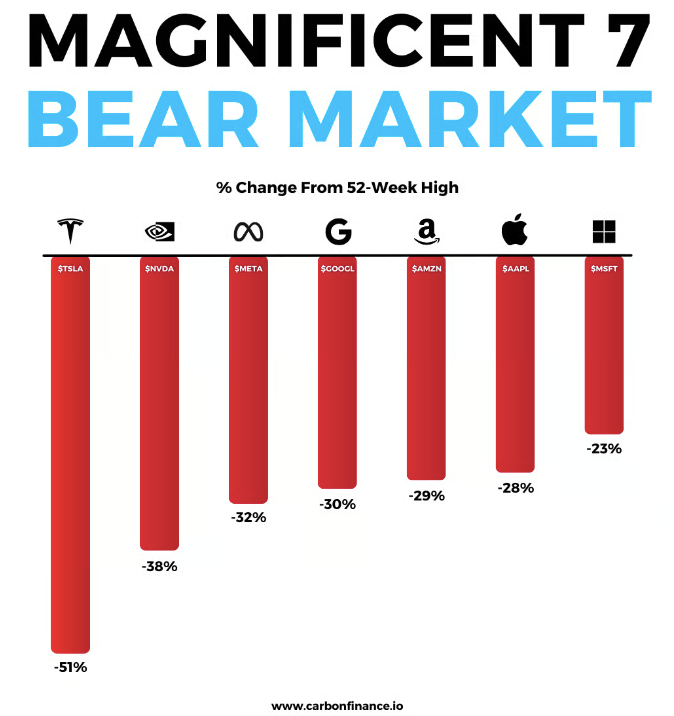

The "Magnificent Seven" tech mega caps, once the market's driving force, have faced a brutal reckoning amid the recent market turmoil.

Collectively, they lost $1.8 trillion in market value over two trading sessions. Apple led the decline, shedding over $533 billion in market capitalization.

President Trump's aggressive tariff plan triggered global panic, with the tech-heavy Nasdaq suffering its worst week since March 2020.

Tesla plummeted more than 10% on Friday alone, losing over $139 billion in two days, while Nvidia shed $393 billion during the same period.

Apple faced additional pressure as new tariffs targeted some of its secondary manufacturing locations outside China, resulting in its worst one-day drop in five years.

Meta and Amazon saw market values plunge by more than $200 billion and $265 billion, respectively, with Amazon logging its ninth consecutive losing week—its worst streak since 2008.

The pain extended beyond megacaps to the broader tech sector. Semiconductor stocks were particularly hard hit, with the VanEck Semiconductor ETF plunging about 15% this week.

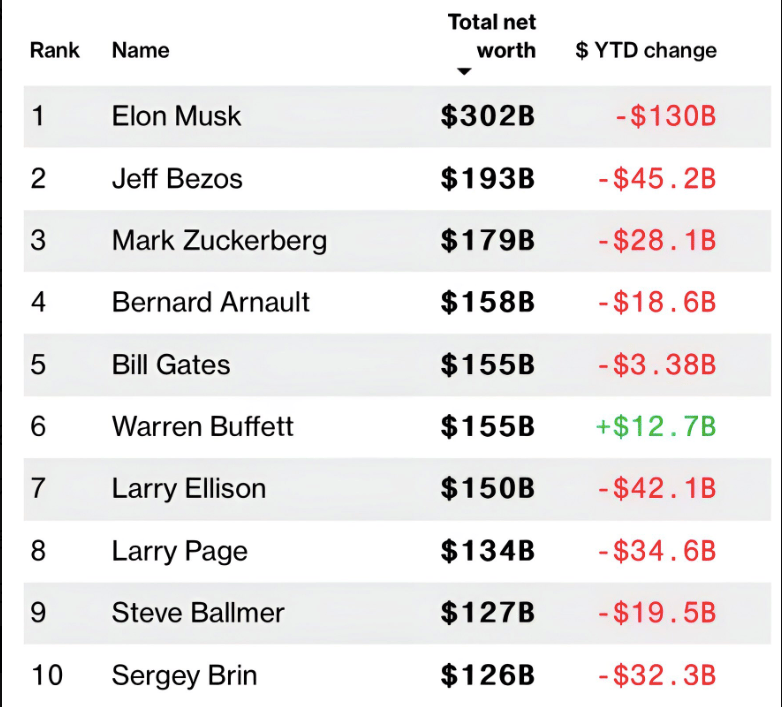

Billionaires Lose Billions Amid Market Meltdown

The two-day market rout erased $30.9 billion from Elon Musk's fortune, $23.49 billion from Jeff Bezos, and $27.34 billion from Mark Zuckerberg – the world's three wealthiest people.

According to Bloomberg's Billionaires Index, the world's 500 richest people experienced their most extensive two-day loss ever recorded.

The newly announced tariffs, which include a 32% rate on Taiwan, 26% on India, and an increase bringing China's total to 54%, hit tech stocks hard due to the industry's reliance on global manufacturing and supply chains.

Musk, who serves as a senior advisor to Trump and leads the administration's Department of Government Efficiency (DOGE), was already facing challenges with Tesla reporting its worst sales quarter since 2022.

His fortune has decreased by $130 billion in 2025, though his current net worth of $302 billion remains well ahead of Bezos ($193 billion) and Zuckerberg ($179 billion).

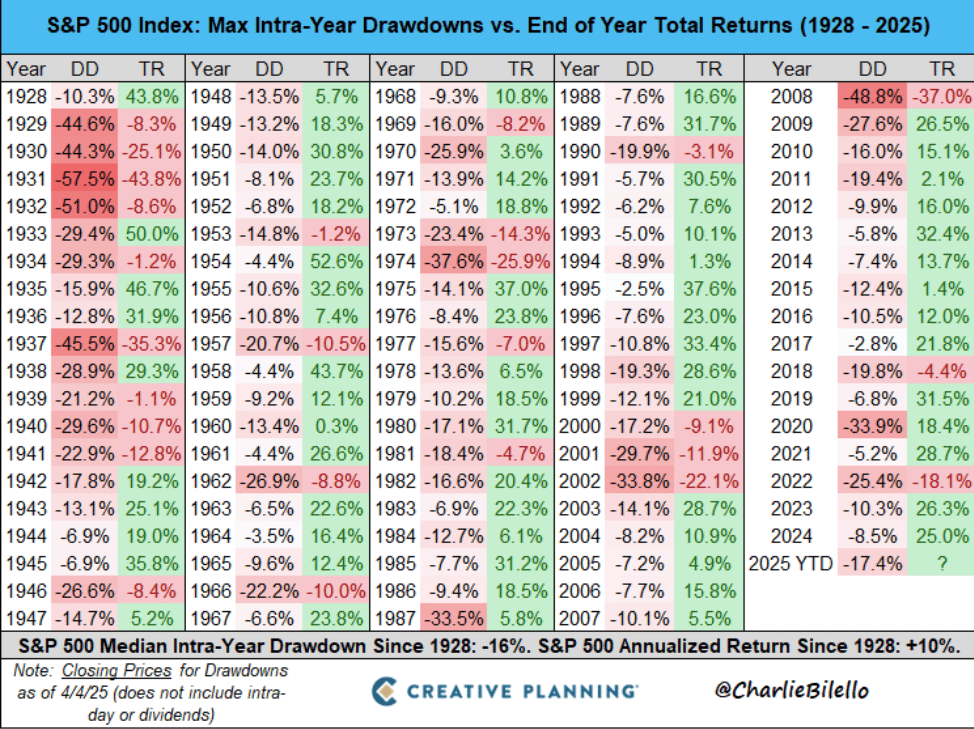

S&P 500: Drawdowns vs. Returns (1928-2025)

If you had invested $10 in the S&P 500 at the beginning of 1928 and increased your annual contribution by 10% each year through 2025, your portfolio would now be worth approximately $17.5 million.

This remarkable growth represents:

Total contributions over 98 years: $1.14 million

Total investment growth: $16.35 million

A 15.36x multiple on your invested capital

An effective annual return of 15.80%

Key milestones in your investment journey would include:

1950: $2,067

1975: $41,377

2000: $2.02 million

2008 (during financial crisis): $1.69 million

2024: $17.39 million

This calculation demonstrates the extraordinary power of consistent investing, contribution increases, and compound growth.

Headlines You Can't Miss!

China stocks lead sell-off

Here’s how the U.S. arrived at its tariff figures

Jaguar Land Rover pauses U.S. shipments amid tariff war

U.S. crude oil falls below $60

Cryptocurrencies join global market rout

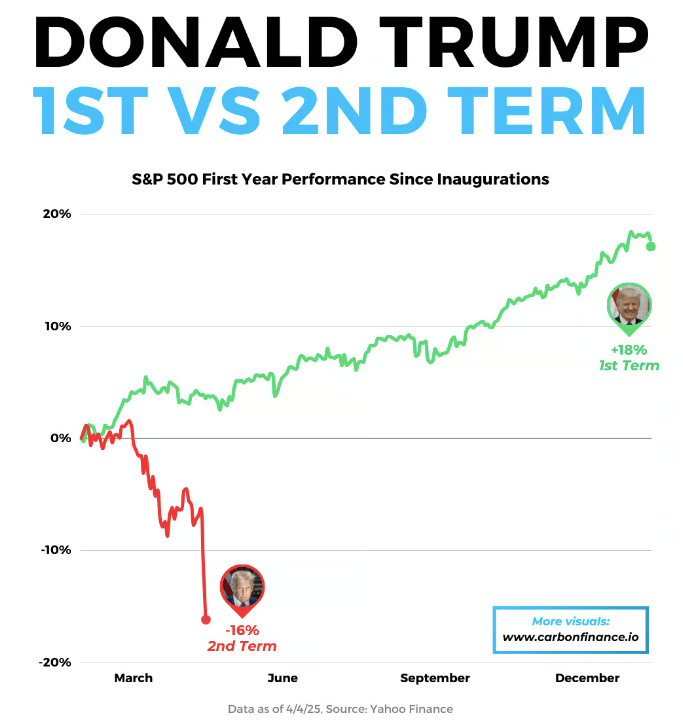

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.