- 3 Big Scoops

- Posts

- 🗞 ASML Drags Chip Stocks Lower

🗞 ASML Drags Chip Stocks Lower

ASML, UnitedHealth, and Walgreens 💰

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

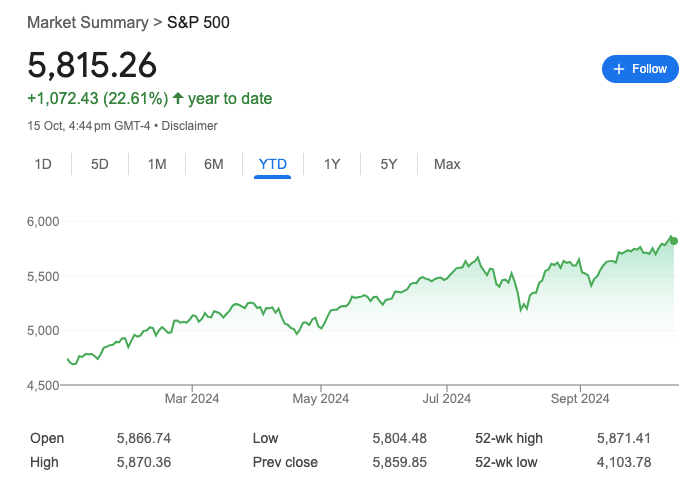

S&P 500 @ 5,815.26 ( ⬇️ 0.76%)

Nasdaq Composite @ 18,315.59 ( ⬇️ 1.01%)

Bitcoin @ $67,298.87 ( ⬆️ 2.01%)

Hey Scoopers,

Happy Wednesday! Are you ready to tackle the midweek mania?

👉 ASML tanks 15.6%

👉 UnitedHealth’s forecasts disappoints

👉 Walgreens is on the move

So, let’s go 🚀

Market Wrap

Stocks tumbled on Tuesday, taking a hiatus from their rally, as traders sifted through the latest corporate earnings reports.

ASML led the sell-off, dragging other chip stocks lower. Semiconductor giants such as Nvidia and AMD shed 4.7% and 5.2%, respectively, while the VanEck Semiconductor ETF fell 5.4% for its worst day since September 3rd.

Notably, the semiconductor sector was also under pressure following a Bloomberg report stating that the Biden administration is considering limiting AI chip sales to certain countries overseas.

Elsewhere, 40 S&P 500 companies have reported Q3 results, 80% of which have surpassed analyst estimates.

While the S&P 500 index is up 20% in 2024, a strong Q3 earnings season and robust fundamental backdrop could sustain stocks at current levels into the year’s end.

Trending Stocks 🔥

LVMH - The stock fell over 5% to its lowest level since October 2022 after the luxury goods giant reported revenue of 19.8 billion euros in Q3, below estimates of 19.87 billion euros.

Johnson & Johnson - Shares rose 1.55% after the healthcare conglomerate exceeded estimates due to strong sales of oncology drugs. It also raised revenue and earnings guidance for Q4 of 2024.

Etsy - The stock rose over 3% even as Goldman Sachs downgraded the online marketplace to “sell” from “neutral,” highlighting the risk of compressed profit margins and market share erosion.

UpMarket has helped over 500 investors place $175M in the private market since 2019. Through UpMarket, accredited investors have invested in OpenAI, SpaceX, Nueralink, Anthropic, xAI and more.

All investments have the risk of loss. UpMarket is not associated with or endorsed by the above-listed companies. Only available to eligible accredited investors. View important disclosures at www.upmarket.co

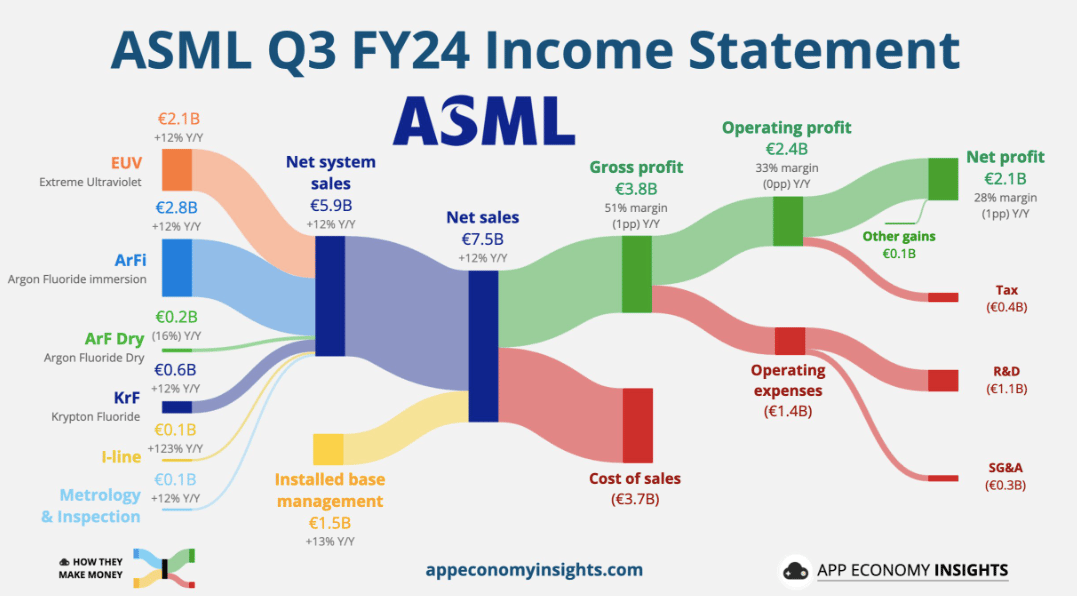

ASML Disappoints Wall Street

Shares of semiconductor equipment maker ASML fell 16% on Tuesday after the Dutch company issued a disappointing sales forecast.

ASML expects net sales between $32.7 billion and $38.1 billion in 2025, which was at the lower half of the range it previously provided. Moreover, the company ended Q3 with net bookings of $2.83 billion, more than 50% below consensus estimates.

ASML is also facing a tougher business outlook in China due to U.S. and Dutch export restrictions on shipments. The U.S. government rolled out new export controls on critical technologies, including advanced chipmaking tools, to China last month.

The restrictions would mean sales originating from China would account for 20% of total revenue in 2025, compared to 49% in Q2 of 2024.

ASML’s extreme ultraviolet lithography machines are used by many of the world’s largest chipmakers — from Nvidia to Taiwan Semiconductor Manufacturing — to produce advanced chips.

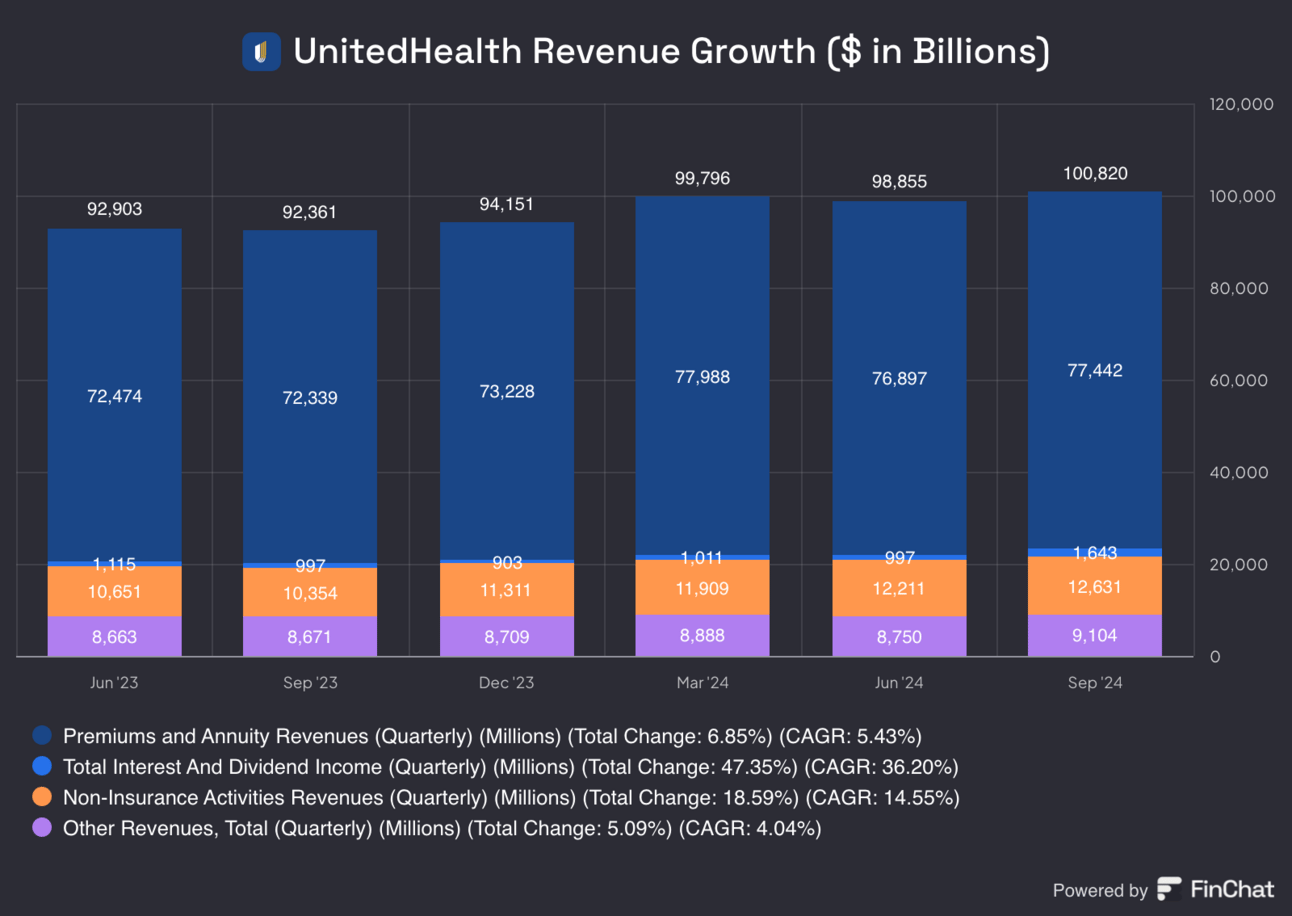

UnitedHealth Stock Tanks Over 8%

UnitedHealth stock tumbled over 8% yesterday after its profit forecast for 2025 missed estimates as the company emphasized it expects pressure across its government-supported health insurance business.

UnitedHealth is the largest insurer in the U.S., forecasting earnings of $30 per share in fiscal 2025, below estimates of $31.18 per share.

However, UnitedHealth CEO Andrew Witty explained that the forecast was conservative due to cuts in payments from government-supported Medicare plans and low state payment rates for low-income people.

The insurance bellwether’s outlook also dragged shares of peers such as CVS Health, Elevance, and Humana lower.

Further, UnitedHealth’s Q3 medical costs exceeded consensus estimates as it paid out more due to high demand for healthcare services while receiving lower reimbursements on government-backed plans.

It also trimmed the higher end of its 2024 adjusted earnings forecast by 25 cents to $27.75 per share.

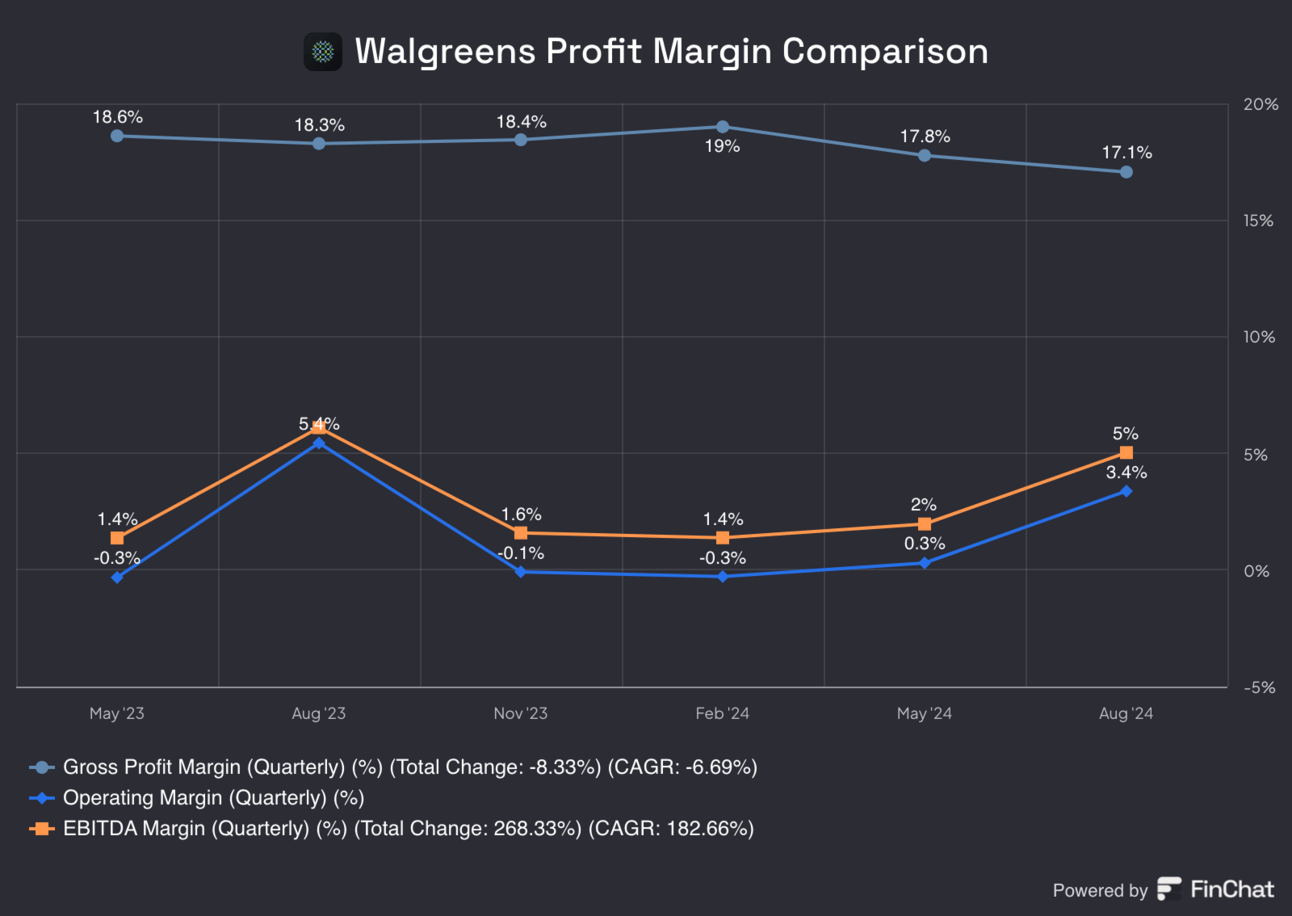

Walgreens Stock Surges Over 15%

Walgreens reported sales and adjusted profit that beat estimates in fiscal Q4 of 2024 (which ended in September) as it slashed costs to steer itself out of a rough spot.

The retail drugstore disclosed plans to close 1,200 stores in the next three years, which includes 500 closures in fiscal 2025. These store closures should be accretive to adjusted earnings and free cash flow.

Walgreens has around 8,700 locations in the U.S., a quarter of which are unprofitable. According to the company, the closures will result in a healthier store base, enabling it to respond to shifts in consumer behavior and buying preferences.

In fiscal 2024, Walgreens surpassed its target of cutting $1 billion in costs by reducing its employee count, shutting stores, and leveraging AI to optimize its supply chain.

In fiscal Q4 of 2024, Walgreens reported:

👉 Revenue of $37.55 billion vs. estimates of $35.76 billion

👉 Earnings per share of $0.39 vs. estimates of $0.36

Its sales rose by 6%, while its GAAP net loss stood at $3 billion or $3.48 per share. The net loss was attributed to a valuation allowance meant to reduce Walgreens’ deferred tax assets related to opioid settlements.

In fiscal 2025, Walgreens expects growth in the U.S. healthcare and international segments, offsetting a decline in the retail pharmacy business.

In fiscal 2025, it forecasts sales between $147 billion and $151 billion, with adjusted earnings between $1.40 and $1.80 per share. Wall Street expects fiscal 2025 sales at $147.3 billion with earnings of $1.75 per share.

Headlines You Can't Miss!

UK inflation falls to 1.7%, below BoE targets

Alibaba’s AI translational tool beats Google and ChatGPT

Asian chip stocks fall as ASML disappoints Wall Street

Big Tech is turning to nuclear energy to power data centers

Bitcoin dominance at 3.5-year high

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.