- 3 Big Scoops

- Posts

- Barclays Downgrades Apple

Barclays Downgrades Apple

Apple, Tesla and Copper

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 4,742.83 ( ⬇️ 0.57%)

Nasdaq Composite @ 14,765.94 ( ⬇️ 1.63%)

Bitcoin @ $45,253.90 ( ⬇️ 0.05%)

Hey Scoopers,

Happy Wednesday. Ready to tackle the midweek hustle?

Here’s what’s on the menu for today:

👉 Apple downgrade drives tech sell-off

👉 Copper prices might surge 75% by 2025

👉 Bitcoin tops $45,000

So, let’s go 🚀

Apple Stock Slumps 4%

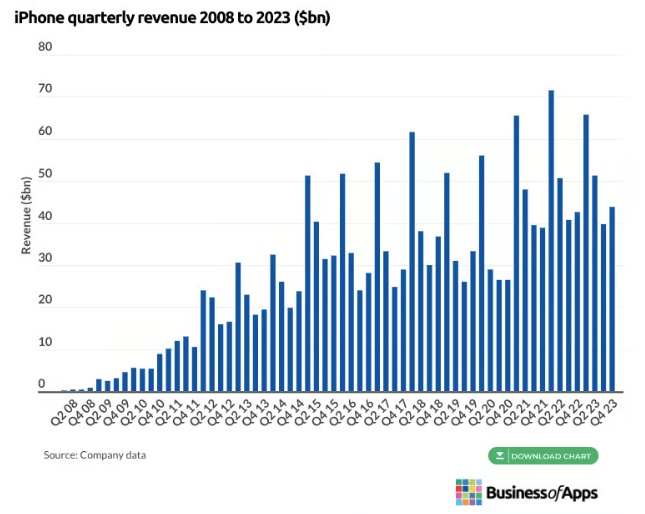

Apple shares fell by 4% yesterday after Barclays downgraded the tech stock to “underweight,” reducing its price target to $160 from $161. Shares of the tech giant are currently priced at $185.

Barclays analyst Tim Long explains lackluster iPhone 15 sales in key markets such as China led to the downgrade. According to Bloomberg, in 2023, China’s government issued an informal guidance prohibiting state employees from using iPhones.

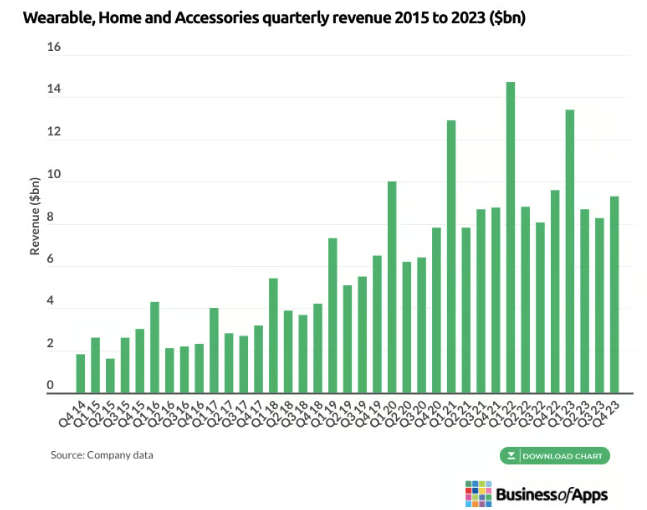

Moreover, Long expects Apple’s other hardware businesses, such as wearables and Macs, to experience weakness in the near term. According to Long, Apple’s lucrative Services business will also see decelerated growth.

The gross margins for Apple’s Services business are roughly double the margin Apple makes on its hardware products.

There are also concerns over the take rates surrounding the App Store. Historically, Google and Apple have taken a 30% cut on app store transactions, which has come under regulatory scrutiny.

Alphabet CEO Sundar Pichai had previously confirmed the company pays 36% of its Safari search revenue to Apple, amounting to billions of dollars.

Following the downgrade, shares of several Apple suppliers, including Taiwan Semiconductors, fell yesterday.

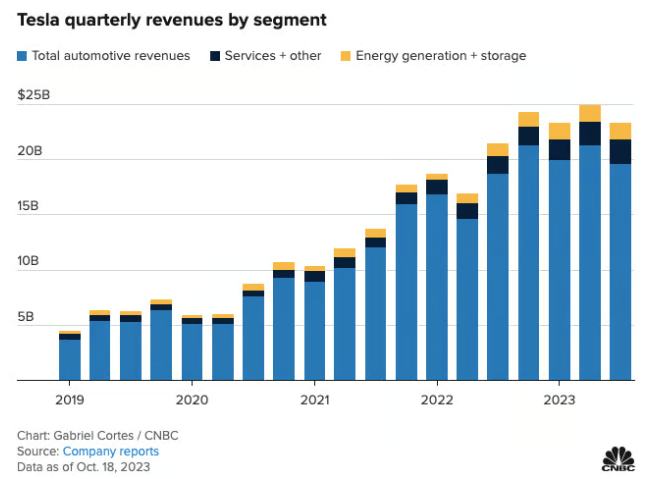

Tesla Ships 1.8 Million Cars in 2023

Tesla published its Q4 vehicle production and deliveries report for 2023. Here are the key numbers 👇

Total deliveries Q4 2023: 484,507

Total production Q4 2023: 494,989

Total annual deliveries in 2023: 1,808,581

Total annual production in 2023: 1,845,985

Tesla’s annual deliveries in 2022 stood at 1.31 million as it produced 1.37 million EVs. It indicates Tesla’s vehicle deliveries surged 38% year over year in 2023, down from 40% in 2022.

Last October, Tesla revised its vehicle delivery forecast to 1.8 million, down from 2 million due to lower consumer demand amid rising interest rates and inflation.

Wall Street estimated Tesla would end Q4 with 477,000 deliveries. While the EV giant beat estimates, it continues to wrestle with lower profit margins and falling cash flows.

Tesla lowered vehicle prices significantly in the last year to boost consumer demand. So, despite a 38% growth in deliveries, analysts expect Tesla’s revenue to rise by just 8% year over year in 2023.

Copper Prices Set to Soar

Copper prices are set to soar 75% by the end of 2025 due to mining supply disruptions and higher demand fueled by the push toward clean energy.

According to a BMI report, the worldwide transition toward clean energy and a decline in the U.S. dollar in the second half of 2024 might push copper prices higher.

As countries fight climate change, demand for Copper might grow by an additional 4.2 million tons by 2030, pushing copper prices to $15,000 a ton. Copper prices touched a record high of $10,730 per ton in March 2022.

The price target for Copper depends on factors such as global growth recovery, China’s robust GDP numbers, and a soft landing in the U.S.

Generally, a growing economy boosts copper demand as it’s used across industries and sectors.

Bitcoin Off To a Bang In 2024

Bitcoin prices are trading at $45,200 at the time of writing, the highest price since April 2022. On Tuesday, the world’s largest cryptocurrency hit an intraday high of $45,913.30.

The recent uptick in BTC prices emphasized Bitcoin’s role as a hedge against uncertainty amid a challenging macro environment.

The initial surge in BTC prices began in early 2023 when several regional banks in the U.S. faced a liquidity crisis. These events allowed the cryptocurrency to shine as an alternative to the legacy banking system.

Several other factors are driving Bitcoin prices higher, including:

👉 The upcoming halving event

👉 Possibility of lower interest rates

👉 The potential launch of multiple spot Bitcoin ETFs

Headlines You Can’t Miss!

Shares of Apple suppliers fall post downgrade

‘Big Short’ investor is cautious about Wall Street’s optimism

Oil prices volatile as Iranian warship enters Red Sea

Nasdaq notches its worst day since October

DoJ shelves campaign finance charges against SBF

Chart of the Day

The US government might be neck-deep in debt, but Americans appear to be doing alright. That’s the encouraging takeaway from this chart from investment bank Goldman Sachs.

Have a look at the dark blue line: it adds together the average US household’s stock investments (darker blue shaded area), home equity (gray shaded area), and other assets (light blue), then shaves off what that household owes (red), to show its average net worth, compared to disposable income.

And with the value of those assets at close to eight times the income, you’re looking at an almost record high. The diagonal lines at the far right show Goldman’s forecasts for each category.

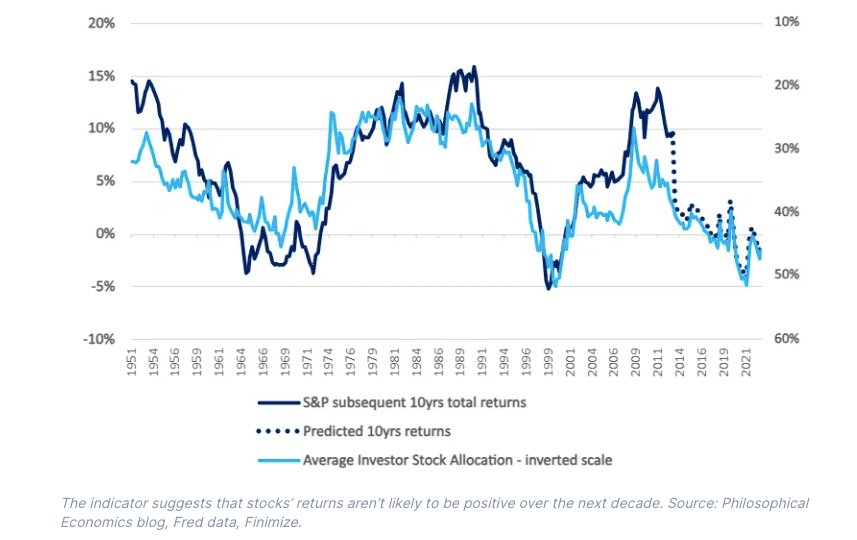

The obvious conclusion is that, even after a couple of very challenging years, shoppers are entering 2024 in great shape – which should bode well for the US economy. But there’s a less obvious point to make, and it’s more cautionary.

See, equity assets (that’s stocks) have contributed the most to net wealth since 2010 – not surprising since stock ownership is at record highs. Now, that’s good if stock markets continue to do what they’ve been doing – i.e., going up.

But after such a strong run in 2023, it wouldn’t be a massive surprise if markets were to take a breather or dip in 2024. And if that happens, Americans will feel their wealth suddenly diminish.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research