- 3 Big Scoops

- Posts

- 🗞 Apple Leads Tech Sell-Off

🗞 Apple Leads Tech Sell-Off

Apple, Target, and Tesla

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

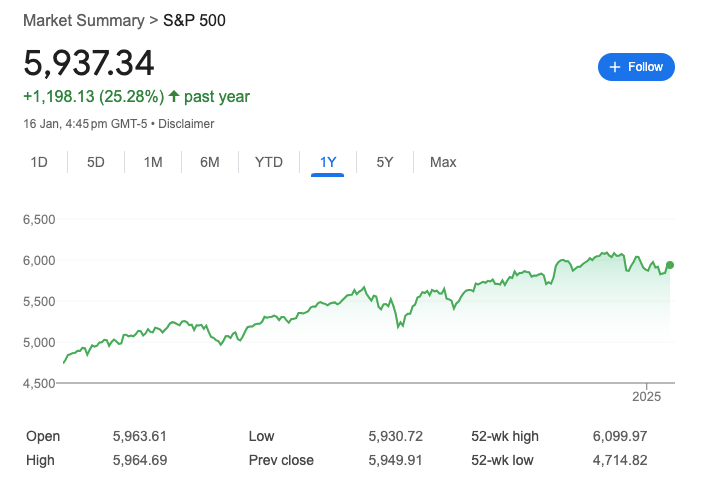

S&P 500 @ 5,937.24 ( ⬇️ 0.21%)

Nasdaq Composite @ 19,338.29 ( ⬇️ 0.89%)

Bitcoin @ $101,482.33 ( ⬆️ 4.16%)

Hey Scoopers,

Happy Friday! The extended weekend is here!

👉 Apple sinks lower

👉 Target raises Q4 forecast

👉 EV demand remains steady in 2024

So, let’s go 🚀

Wall Street loads up on surprising $2.1tn asset class

Bank of America. UBS. JP Morgan. They’re all building (or have already built) massive investments in one $2.1tn asset class—and it’s not what you think. It’s not private equity or real estate, but fine art. Why?

In partnership with Masterworks, data from Citi shows it’s a potent diversifier with low correlation, and certain segments have even outpaced traditional investments. Take blue-chip contemporary art, which has outpaced the S&P 500 by 64% (1995-2023).

Masterworks knows the power of art investing, with their platform giving 900k+ users the opportunity to invest in this asset class as part of their overall portfolio strategy. In fact, from their 23 exits so far, Masterworks investors have realized representative annualized net returns like +17.6%, +17.8%, and +21.5%* (among assets held for longer than one year).

With so many users, Masterworks offerings can sell out quickly.

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

Market Wrap

Hey, Scoopers!

The market's winning streak hit pause yesterday, with Big Tech names leading the slowdown.

But here's the interesting part: while tech giants were catching their breath, the banking sector told a different story about the economy's health.

Let's break down what matters for your portfolio:

The Tech Tumble

Apple dropped 4% (its biggest slide since August), while Tesla, Nvidia, and Alphabet suffered losses between 1% and 3%.

The Banking Bright Spot

Morgan Stanley's earnings jumped 4%, and Bank of America also beat expectations, though investors seemed to want more.

Here's the key takeaway: 77% of companies reporting so far have exceeded expectations, a strong signal for the broader market.

Big Picture View

We're seeing a healthy market rotation. While tech takes a breather, other sectors are showing strength.

Remember Wednesday’s rally? The Dow jumped 700 points on improving inflation data—the fundamental support long-term investors want to see.

Trending Stocks 🔥

Netflix - The streaming giant added over 1% before shedding gains on Seaport’s upgrade to “Buy” from “Neutral.”

United Health Group - The stock shed over 6% after UnitedHealth posted revenue of $100.8 billion and adjusted earnings of $6.81 per share, compared to estimates of $101.76 billion and $6.72 per share, respectively.

DigitalOcean Holdings - Morgan Stanley upgraded the software company to “Overweight” from “Equal-Weight,” leading shares 3% higher. The firm said the stock is not pricing in its ability to serve larger customers and is giving “little to no credit” to artificial intelligence and machine learning opportunities.

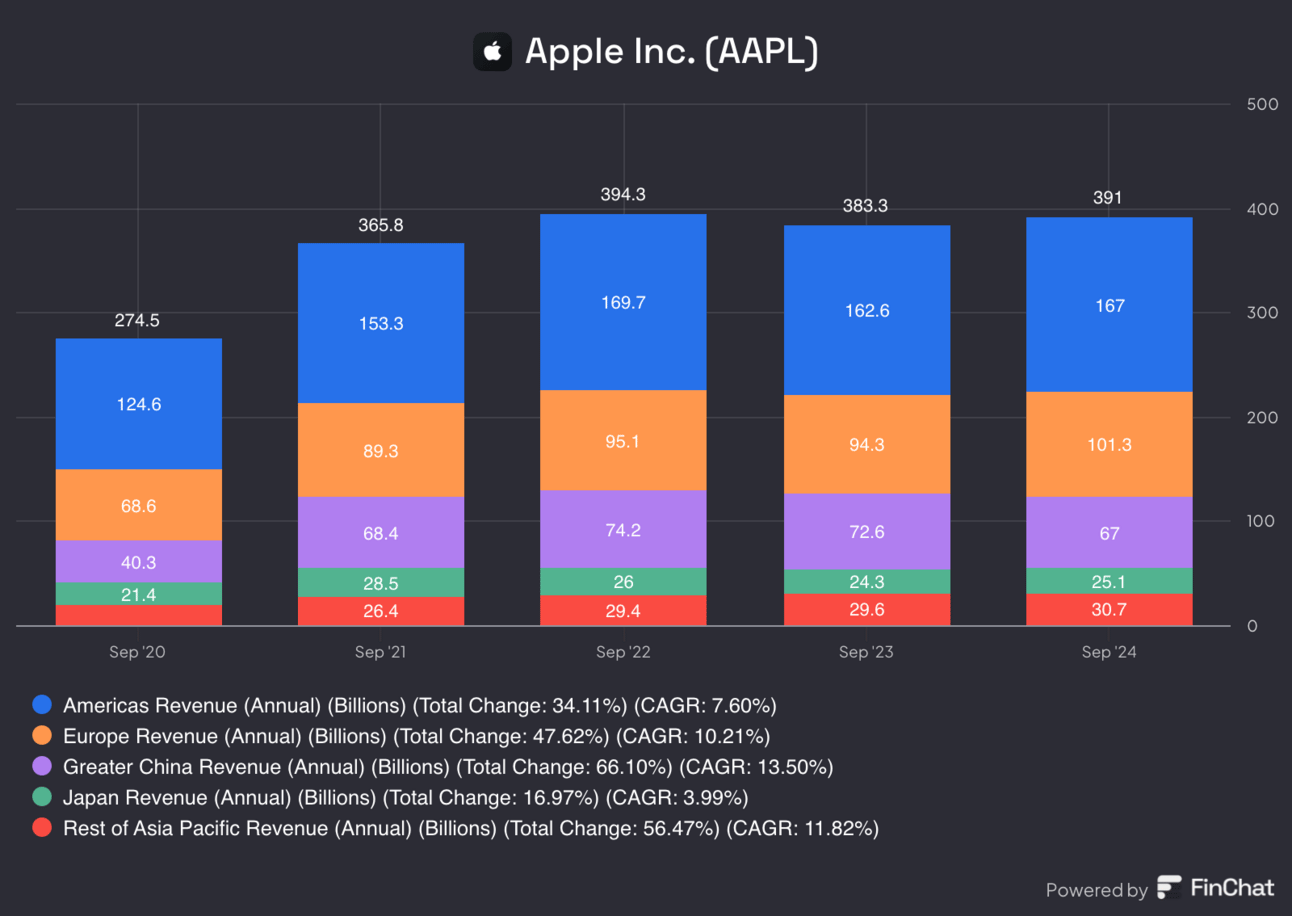

Apple's China Challenge

Big news from the tech world is shaking up one of America's most beloved stocks.

Apple had its roughest day since August, dropping 4% as concerns about its Chinese market share started to bubble up.

The Big Picture

Apple's down nearly 12% from its December peak

It's currently the worst performer among major tech stocks in 2025

Chinese competitors are gaining ground in their home market

Here's what's interesting: Apple went from top dog to third place in China's smartphone market, falling behind local players Vivo and Huawei.

The numbers tell the story: Apple shipped 15% of China's 284 million phones last year, a 17% drop from the previous year.

Why This Matters For Investors

TSMC (Apple's chip supplier) is forecasting lower smartphone chip demand

Analyst Ming-Chi Kuo expects iPhone shipments to drop 6% in early 2025

Apple's AI features haven't yet launched in China, potentially limiting growth

Mark Your Calendar: Apple reports earnings on January 30th, which should give us a clearer picture.

Remember: Short-term volatility doesn't change long-term fundamentals. Keep your focus on the bigger picture! 📈

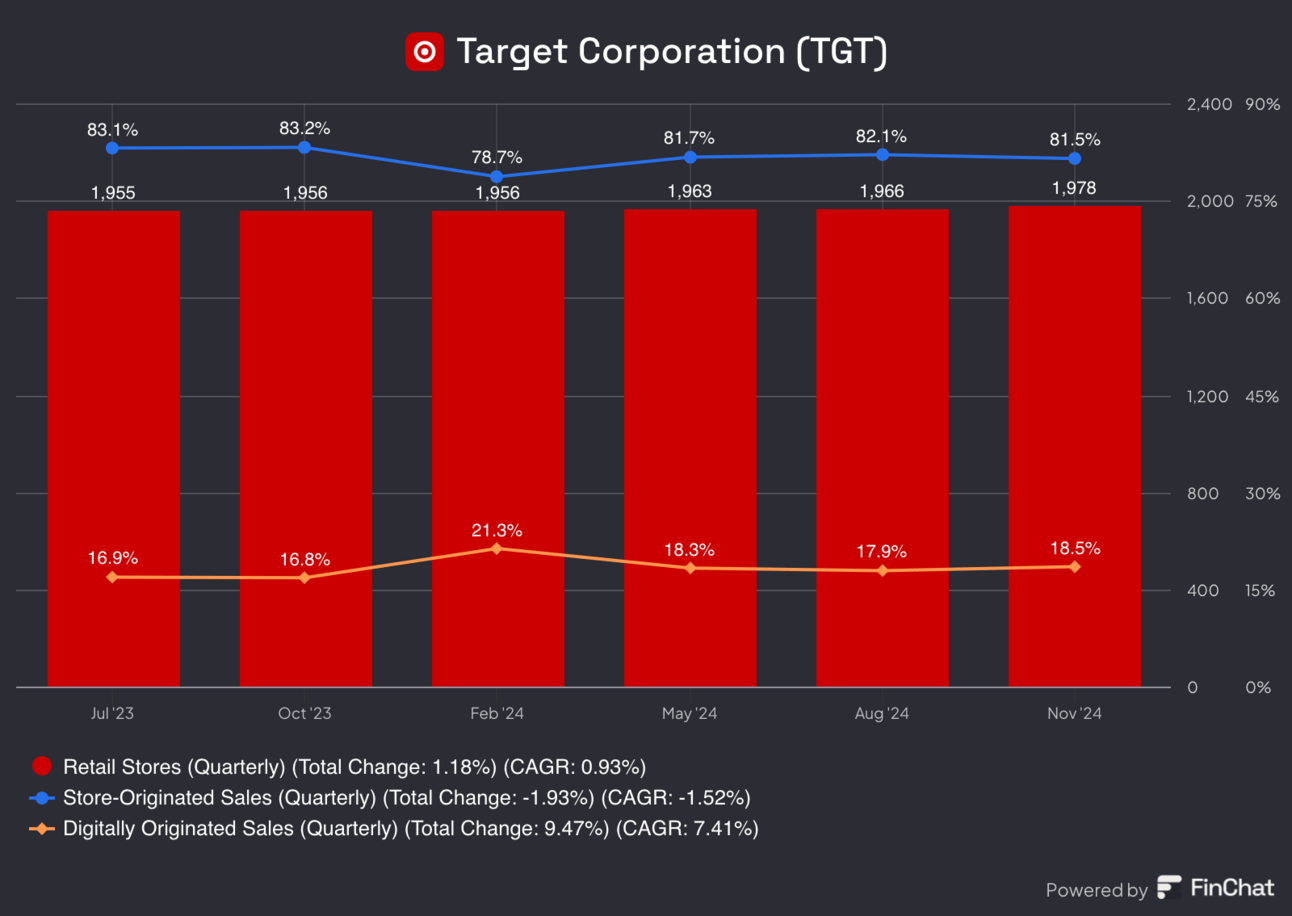

Target's Holiday Surprise

Target dropped some interesting news that tells us a lot about the retail sector and consumer behavior. Let's break down what matters for investors:

The Good News

Q4 sales are expected to grow 1.5% (better than the previous flat forecast)

Holiday traffic is up 3% both online and in-store

Digital sales jumped 9% during the holiday season

The marketplace business (Target Plus) soared nearly 50%

The Plot Twist

While sales are up, profit forecasts remain unchanged. This tells us an important story about today's consumers: They're still spending but hunting for deals like never before.

The Bigger Picture

Total holiday retail sales hit $994.1 billion (up 4% from last year), showing consumers are still opening their wallets.

But here's the fascinating part: Consumers are being incredibly strategic about when they spend.

Target saw huge spikes during promotional events like Black Friday and Cyber Monday, followed by quieter periods.

Target is adapting to this new reality by 👇

Cutting prices on 10,000+ everyday items

Boosting their same-day delivery service (up 30%)

Focusing on high-margin categories like apparel and toys

Investment Takeaway

Target's results give us valuable insights into consumer behavior. While spending remains healthy, shoppers are increasingly price-conscious.

For investors, this suggests companies that can balance growth with innovative promotional strategies.

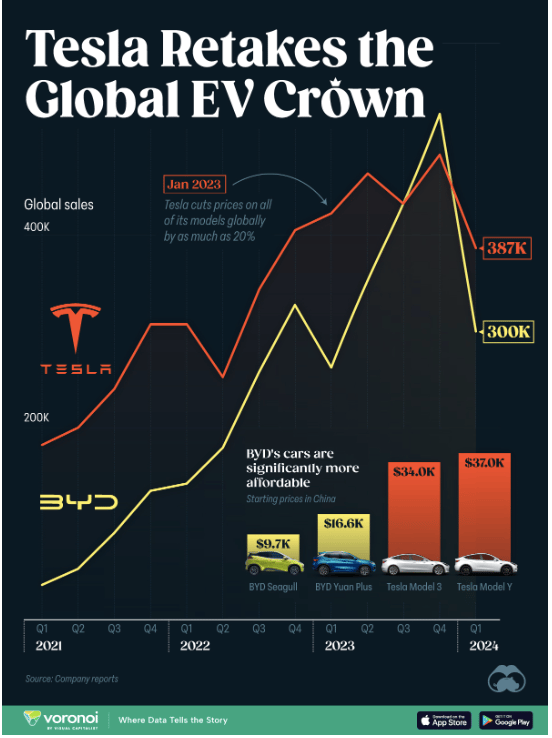

The Electric Revolution

Big news from the auto world that could impact your investment strategy: "Green" vehicles just hit a historic milestone, capturing 20% of all new car sales in the U.S.

Let's plug into what this means for investors:

The Numbers That Matter

3.2 million "electrified" vehicles sold in 2024

1.9 million were hybrids

1.3 million were pure electric vehicles

Traditional gas/diesel vehicles dropped below 80% market share for the first time ever

The Tesla Story

While Tesla still dominates the EV market in the U.S. with a 49% share, its grip is loosening (down from a 55% share in 2023).

But here's what's fascinating - the Model Y and Model 3 remained the top-selling EVs despite increasing competition.

The New U.S. Challengers (In terms of market share):

Hyundai/Kia: 9.3%

General Motors: 8.7%

Ford: 7.5%

BMW: 4.1%

Looking Ahead:

Cox Automotive predicts that EVs will account for 10% of new vehicle sales in 2025 and that total "green" vehicle sales will reach 25%.

However, the incoming administration has created some uncertainty about federal tax credits.

Investment Takeaway: While Tesla remains the EV leader, traditional automakers are gaining ground.

Remember: The EV transition isn't just about car companies—it also involves batteries, charging infrastructure, and semiconductor manufacturers.

Major industry shifts like this often create both winners and losers. Stay diversified and watch this space! 🔋📈

Headlines You Can't Miss!

China’s Q4 GDP grows at 5.4%, beats estimates

Duolingo shares climb 7% as users learn Mandarin

U.S. sanctions on Russia hit oil freight rates

China’s ship-building dominance is hurting the U.S.

Lower inflation data pushes BTC past $100k (again!)

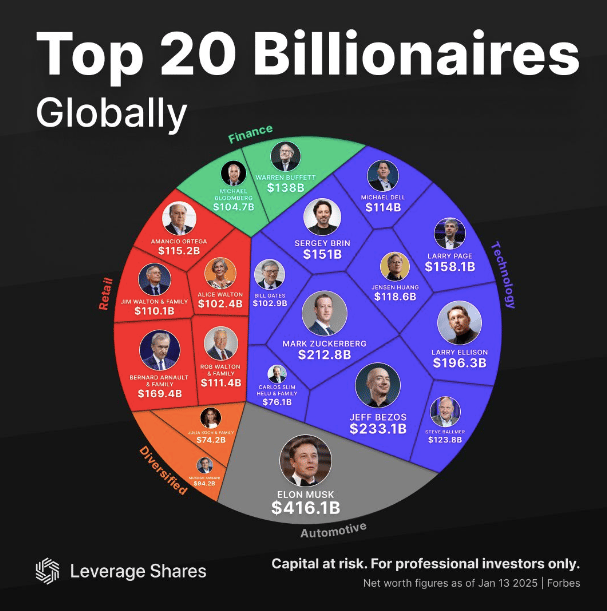

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.