- 3 Big Scoops

- Posts

- 🗞 All Eyes on Nvidia

🗞 All Eyes on Nvidia

PLUS: BoA raises S&P 500 target

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

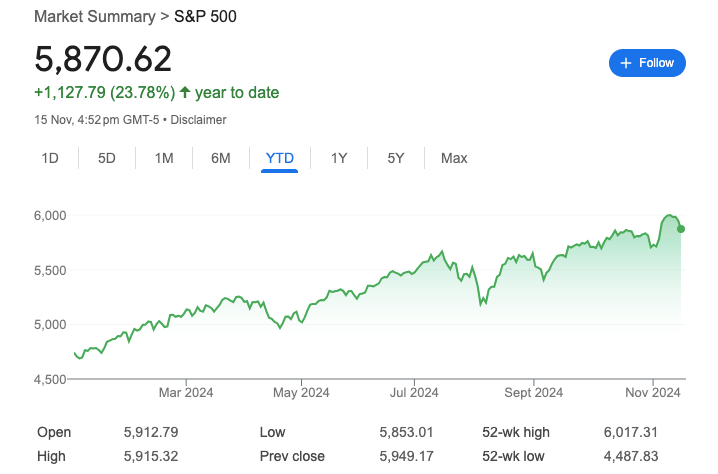

S&P 500 @ 5,870.62 ( ⬇️ 1.32%)

Nasdaq Composite @ 18,680.12 ( ⬇️ 2.24%)

Bitcoin @ $90,538.82 ( ⬆️ 1.88%)

Hey Scoopers,

Happy Monday! Are you ready for an exciting newsletter?

👉 Nvidia’s upcoming earnings

👉 Alibaba’s solid Q3 results

👉 Earnings growth is under pressure

So, let’s go 🚀

Market Wrap

Stocks tumbled on Friday as the postelection rally fizzled and investors fretted over the path of interest rates.

President-elect Donald Trump disclosed plans to nominate vaccine skeptic Robert F. Kennedy Jr. to lead the U.S. Department of Health and Human Services.

This led to declines in sectors such as pharmaceuticals as Amgen slid 4.2%, while Moderna tumbled 7.3%. The SPDR S&P Biotech ETF fell over 5%, posting its worst week since 2020.

The tech sector also pulled back by more than 2% due to the drawdown in big tech stocks such as Nvidia, Meta Platforms, Alphabet, and Microsoft.

What next for the S&P 500?

Around 93% of S&P 500 companies have reported results, 75% of which have surpassed earnings estimates, while 61% have reported a positive revenue surprise.

As the earnings season ends shortly, investors expect the S&P 500 index to finish on a solid note. According to investment firm Bank of America, the S&P 500 index should trade at 6,000 by the end of 2024.

BoA sees limited near-term upside to the cap-weighted S&P 500 and prefers the equal-weighted index as it is statistically expensive on “almost every metric.”

With long-term growth expectations on megacap tech at a record high, BoA sees potential for a market rotation into cyclicals and high dividend-yielding stocks, particularly if a Donald Trump administration supports an increase in U.S. GDP growth and potentially in inflation.

Trending Stocks 🔥

Super Micro Computer - Shares of the server company fell 2% ahead of a deadline that could result in its delisting from the Nasdaq.

Bloom Energy - The stock rose 59% after Piper Sandler upgraded it to “overweight” from “neutral” due to the recent supply agreement with American Electric Power that could power additional growth opportunities for the company.

Applied Materials - Shares tumbled over 9% after the semiconductor equipment manufacturer forecast revenue of $7.15 billion in the current quarter, lower than estimates of $7.224 billion.

Nvidia’s Earnings Results

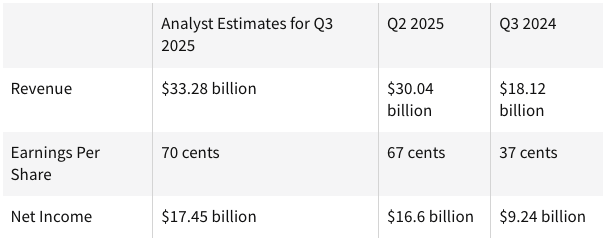

Nvidia, the largest company on the planet, is scheduled to announce its quarterly results this week. The market bellwether is forecast to report:

👉 Revenue of $33.28 billion, up from $18.1 billion last year

👉 Earnings per share of $0.70, up from $0.37 last year

👉 Net income of $17.45 billion, up from $9.24 billion last year

It shows that analysts expect Nvidia’s revenue and earnings to grow over 80% year over year in fiscal Q3 of 2025 (ended in October).

Nvidia’s largest business is its data center segment, which is forecast to bring in $29 billion in Q3, up from $14.5 billion last year.

Source: Investopedia

In Q2, Nvidia’s data center business hit a record $26.3 billion in sales, and this number is expected to grow by another $3 billion in Q3.

In August 2024, Nvidia CEO Jensen Huang said, “Global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI.”

Last week, Morgan Stanley raised its price target for NVDA stock to $160 from $150 and maintained an “overweight” rating, citing the strength of its data center growth.

"We expect NVDA's Data Center business to drive much of the growth over the next 5 years, as enthusiasm for generative AI has created a strong environment for AI/[machine learning] hardware solutions," the analysts said.

Alternatively, supply constraints might limit the upside of Nvidia’s near-term outlook as upward revisions are likely to happen over the next six months as the production of Nvidia’s Blackwell chips ramps up.

Are S&P 500 Earnings Under Pressure?

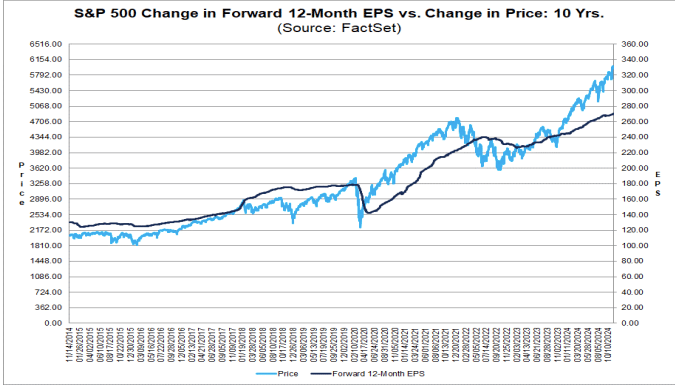

The S&P 500 blended earnings growth rate, which includes reported numbers and estimates for Q3 of 2024, is 5.4%, the fifth straight quarter of earnings growth for the flagship index.

Source: FactSet

But are there chinks in the armor of Q3 corporate profits? For instance:

75% of companies have beaten earnings estimates in Q3, below the five-year average of 77%.

Further, S&P 500 companies have topped forecasts by 4.3%, well below the five-year average of 8.5%.

Of the 80 companies in the S&P 500 that have estimated Q4 earnings, 68% have issued negative guidance, while 32% have made positive forecasts.

Comparatively, the five-year average for companies with negative guidance is lower at 58%.

Finally, the forward price-to-earnings ratio for the S&P 500 stands at 22x, above the five-year average of 19.6x and the 10-year average of 18.1x.

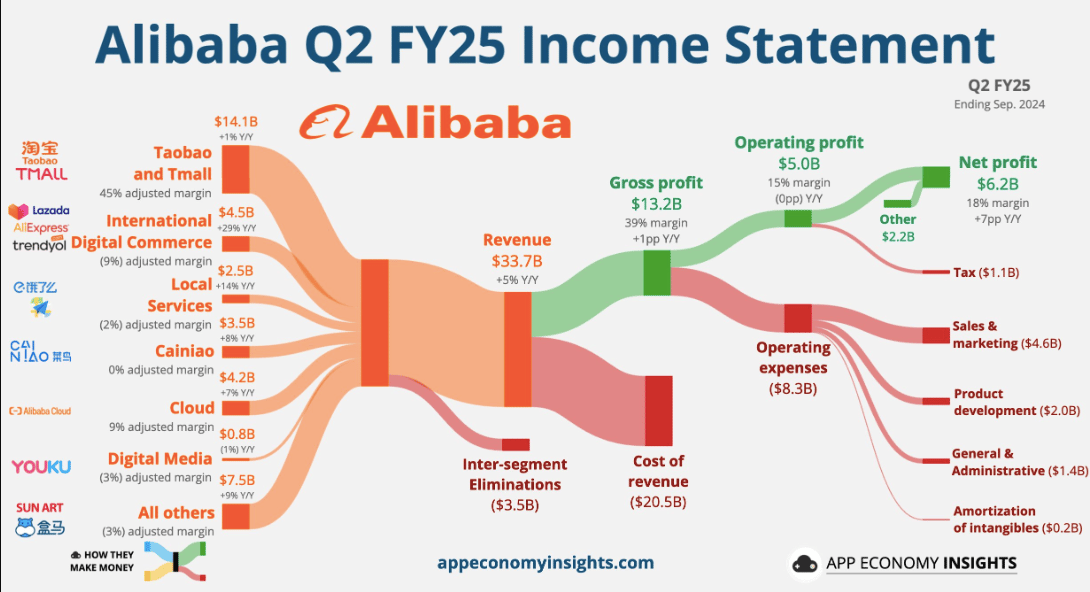

Alibaba Misses Revenue Estimates in Q3

Chinese e-commerce behemoth Alibaba beat profit expectations in its September quarter, but sales fell short as sluggishness in the world’s second-largest economy hit consumer spending.

Alibaba’s net income rose 58% year over year to $6.07 billion in Q3 due to the performance of its equity investments, beating earnings estimates by almost 100%. Meanwhile, revenue grew by 5% to $33.7 billion, below estimates of $34 billion.

China is grappling with a tepid retail environment, forcing other companies, such as JD.com, to miss revenue estimates in Q3.

Markets are now watching whether Beijing's recent stimulus measures, including a five-year 1.4 trillion yuan package announced last week, will help resuscitate the country’s growth and curtail a long-lived real estate market slump.

Alibaba touted “robust growth” in gross merchandise volume — an industry measure of sales over time that does not equate to the company’s revenue — for its Taobao and Tmall Group businesses during the festival, along with a “record number of active buyers.”

The e-commerce giant’s overseas online shopping businesses, such as Lazada and Aliexpress, posted a 29% year-on-year hike in sales to $4.38 billion.

Alibaba’s Cloud Intelligence Group reported year-on-year sales growth of 7% to $4.1 billion in the September quarter, compared with a 6% annual hike in the three months ended in June.

The slight acceleration comes amid ongoing efforts by the company to leverage its cloud infrastructure and reposition itself as a leader in the booming artificial intelligence space.

11.4% Cash Returns with Portfolios of Online Businesses.

WebStreet is a first-of-its-kind investment platform that allows accredited investors to own fractional shares in cash-flowing online businesses.

Our process is simple:

We buy online businesses cash-flowing from day one. 💸

We partner with world-class entrepreneurs to run and scale the businesses. 🚀

You invest, gaining fractional ownership and earning quarterly dividends. 📈

Additionally, you'll share in the profits when we exit these businesses within 2-3 years.

Headlines You Can't Miss!

Samsung surges 7% after announcing $7 billion buyback plan

European SpaceX rival raises $160 million

Tencent eyes the public cloud market

Space stocks saw big gains last week

Crypto ATM operator Bitcoin Depot reports Q3 sales of $135 million

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.