- 3 Big Scoops

- Posts

- 🗞 Airbnb Dips On Earnings Miss

🗞 Airbnb Dips On Earnings Miss

Airbnb, Block, and Bitcoin

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

S&P 500 @ 5,973.10 ( ⬆️ 0.74%)

Nasdaq Composite @ 19,269.46 ( ⬆️ 1.51%)

Bitcoin @ $75,946.33 ( ⬆️ 1.71%)

Hey Scoopers,

Happy Friday! Are you ready for an exciting newsletter today?

👉 Airbnb pulls back

👉 Block misses revenue estimates

👉 Bitcoin trading volumes surge

So, let’s go 🚀

Market Wrap

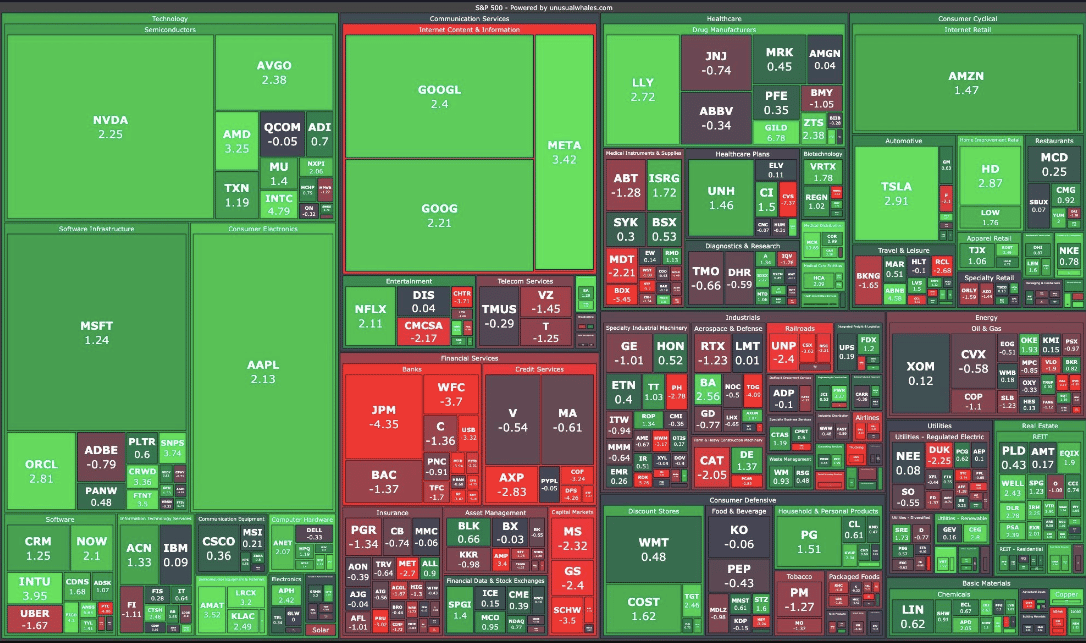

The S&P 500 and Nasdaq rose on Thursday, extending Wall Street’s rally after President-elect Donald Trump’s victory, as traders weighed the latest 0.25% rate cut from the Federal Reserve.

The moves built on a surge in stocks after Trump’s win, including Wednesday's 1,500-point gain for the Dow Jones index. Moreover, the S&P 500 index jumped 2.53% for its best post-election day in history.

Analysts expect the second Trump administration will be good for risk assets such as stocks due to proposed rate cuts. However, the prospect of continued large government deficits and higher tariffs has raised concerns about a rebound in inflation.

Elsewhere, the bond market has also been volatile since the election, with Treasury yields falling Thursday after spiking in the previous session.

Fed Chair Jerome Powell said the central bank was “feeling good” about the economy's state, and the Fed seems likely to stick to its small moves going forward.

Trending Stocks 🔥

Warner Bros. Discovery - Shares of the streaming platform jumped almost 12% after Q3 earnings reflected its biggest quarterly subscription growth. It added 7.2 million global subscribers in Q3, ending the quarter with 110.5 million subscribers.

AppLovin - The software publisher’s stock price jumped 46% after its Q3 results beat estimates. It forecasts Q4 EBITDA to be $750 million, higher than estimates of $667 million.

Dutch Bros - The stock popped over 28%, following the coffee chain’s better-than-expected Q3 results, where it reported revenue of $328 million and earnings of $0.16 per share, vs. estimates of $325 million and $0.12, respectively.

Airbnb Beats Q3 Estimates

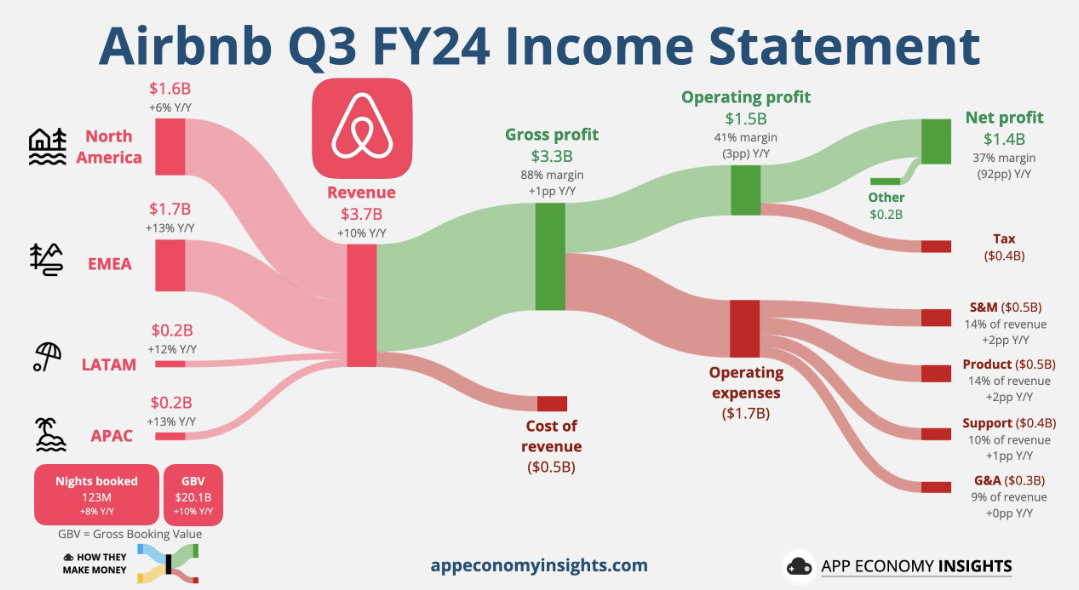

Airbnb announced its Q3 earnings yesterday, which were shy of analyst estimates, though it squeaked in a small revenue beat. In Q3, Airbnb reported:

👉 Revenue of $3.73 billion vs. estimates of $3.72 billion

👉 Earnings per share: $2.13 vs. estimates of $2.14

Revenue rose by 10% year over year from $3.4 billion in the year-ago period. It expects to report revenue between $2.39 billion and $2.44 billion in Q4, compared to estimates of $2.42 billion.

Airbnb remains focused on expanding beyond core markets and gaining traction in under-penetrated markets globally. In Q3, the average growth rate of nights booked in these expansion markets was double that of core markets.

Its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) for Q3 was $2 billion, up 7% year over year, higher than estimates of $1.86 billion.

The company’s gross booking value, which includes host earnings, service fees, cleaning fees, and taxes, totaled $20.1 billion, above estimates of $19.9 billion.

Around 123 million nights and experiences were booked on the Airbnb platform, 8% higher than last year, while consensus estimates stood at 121.4 million.

Block Disappoints in Q3

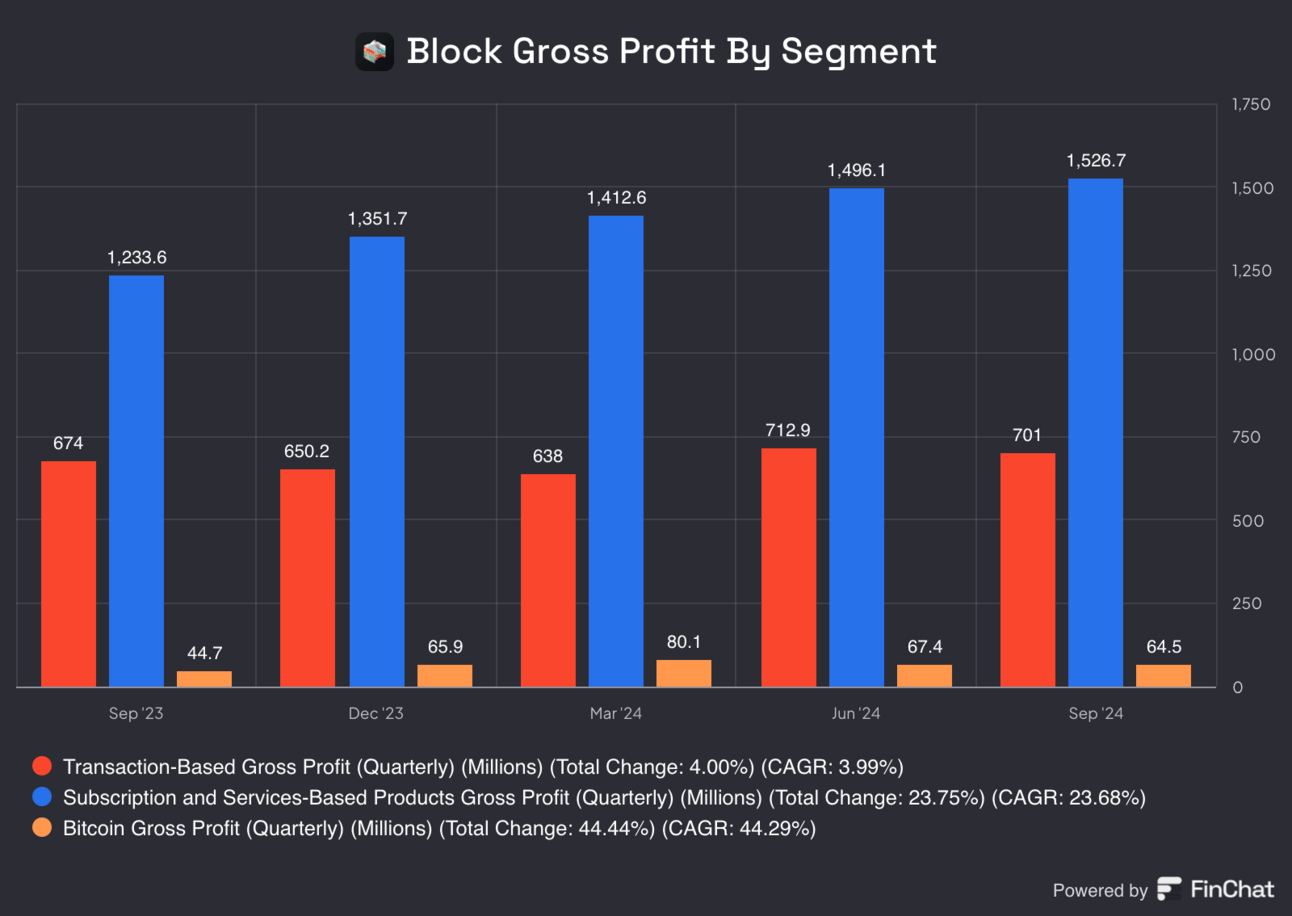

Block reported Q3 revenue that trailed estimates, driving the stock lower in pre-market trading today. In the September quarter, it reported:

👉 Revenue of $5.98 billion vs. estimates of $6.24 billion

👉 Earnings per share of $0.88 vs. estimates of $0.87

However, Block’s finance chief, Amrita Ahuja, explained that analysts focused on gross profit rather than revenue and pointed to the company’s earnings growth in Q3. The fintech company posted $2.25 billion in gross profits, up 19% year over year.

Block operates the Cash App, a popular mobile payments platform and a key driver of profitability. In Q3, the business reported a gross profit of $1.31 billion, up 21% year over year. The Cash App Card now has 24 million monthly active users, up 11%.

Block’s gross payment volume was $62.4 billion, missing estimates of $64.3 billion. The company expects gross profits to rise by 14% to $2.31 billion in the current quarter.

Block acquired Afterpay, an Australian buy-now-pay-later giant, for $29 billion in 2021. The acquisition has allowed Block to expand its lending product portfolio, which now includes Square Loans, Afterpay BNPL, and Cash App Borrow.

Block will soon launch Afterpay on the Cash App Card and aims to transform the latter into a “better alternative to credit cards.”

BlackRock’s Spot Bitcoin ETF Attracts Inflows

BlackRock’s spot Bitcoin ETF, IBIT, recorded its largest daily trading volume of $4.1 billion after U.S. Election Day, which saw pro-crypto Republican candidate Donald Trump reclaim the White House.

The trading volume exceeded that of blue-chip stocks such as Berkshire Hathaway, Visa, and Netflix. Notably, the IBIT trading volume surpassed $1 billion in the first 20 minutes of the trading day following Trump’s win.

The cumulative trading volume for all 12 spot bitcoin ETFs exceeded $6 billion, marking the highest daily total since March.

Meanwhile, JPMorgan analysts expect bitcoin to benefit from Donald Trump's second term as President in what they described as the "debasement trade."

Tariffs, geopolitical tensions, and fiscal policies will reinforce the debasement trade. This investment strategy benefits from a currency's devaluation due to inflationary or expansionary fiscal policies, boosting Bitcoin as a store of value.

A Knockout Night of Sleep, Powered by Plants

THC & CBD to relax and fall asleep

CBN to keep you asleep through the night

Save 25% with code SLP25

Headlines You Can't Miss!

Sony reports a 69% jump in operating profit

China expected to announce fiscal stimulus package

Why is Samsung behind in the AI race?

DraftKings bullish on U.S. sports betting industry

Solana climbs above $200 as Bitcoin zooms to fresh record high

Chart of The Day

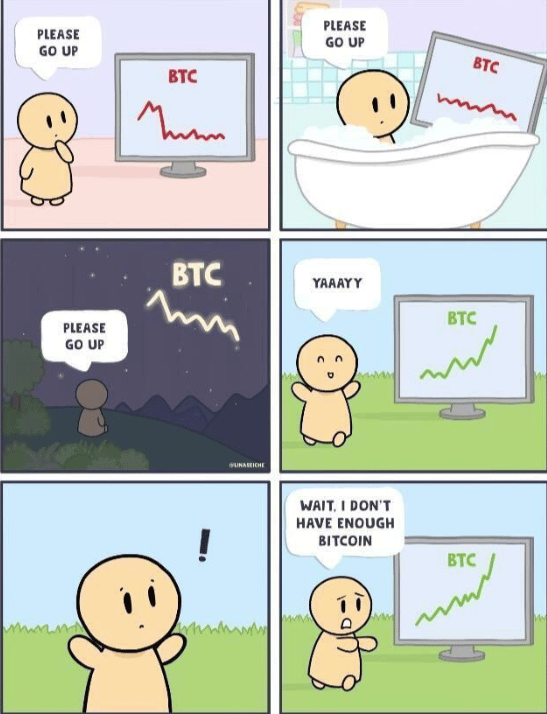

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.