- 3 Big Scoops

- Posts

- Apple Loses to Samsung

Apple Loses to Samsung

PLUS: Can oil soar to $100?

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

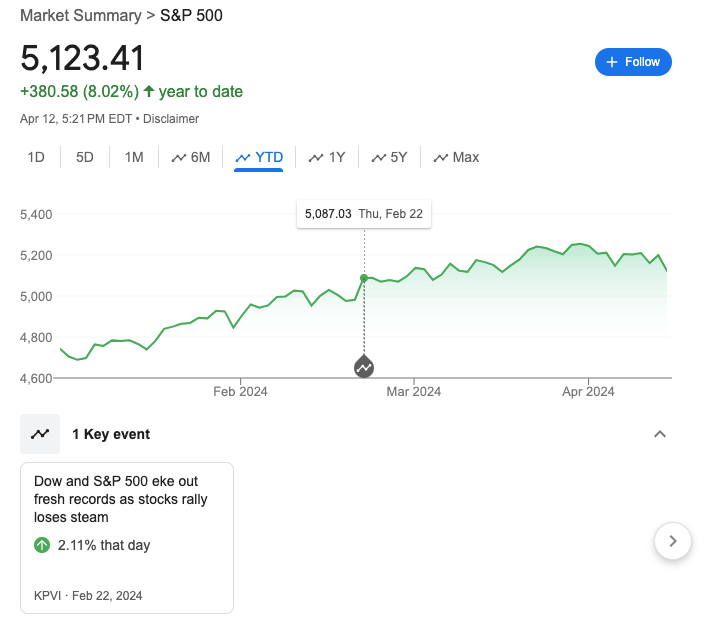

S&P 500 @ 5,123.41 (⬇️ 1.46%)

Nasdaq Composite @ 16,175.09 ( ⬇️ 1.62%)

Bitcoin @ $66,298.30 ( ⬆️ 1.02%)

Hey Scoopers,

Happy Monday! Here’s what we’re covering today 👇

👉 Apple’s iPhone loses market share

👉 Oil prices to gain amid rising tensions

👉 Investors dump Bitcoin

So, let’s go 🚀

Market Wrap 📉

U.S. stock futures ticked higher this morning as investors wrestle with multiple issues, including Iran’s missile and drone strike on Israel and a spike in stock market volatility.

At the time of writing, the S&P 500 futures added 0.42%, while the Dow Jones and Nasdaq futures advanced by 0.36% and 0.45%, respectively.

After rallying 15% in 2024, gold futures pulled back marginally to trade at $2,360 an ounce. The precious metal touched all-time highs last week as investors increased exposure to gold amid sticky inflation and rising geopolitical tensions.

Last Friday, the Dow lost 476 points, while the S&P 500 index posted its worst day since January. Last week, the Dow shed 2.4% and fell for the second week in a row. The S&P 500 index slid 1.5%, posting its worst week since October 2023.

In the next four weeks, investors will be watching for earnings releases from several S&P 500 companies.

Analysts expect the average earnings of companies in the index to rise by 2.7% year over year, while sales growth is forecast at 3.3%. Earnings for the Communications Services sector are forecast to expand by 27%.

Moreover, retail sales data, as well as business inventory data for February and manufacturing numbers for March, are scheduled for today.

Trending Stocks 🔥

JPMorgan Chase - Shares of the banking giant slid over 6% following its Q1 results. The company emphasized that net interest income could be lower than estimates in 2024. CEO Jamie Dimon also warned about persistent inflationary pressures on the economy.

Global Life - The life insurance stock gained 10% after falling over 50 in the previous session. The slide was attributed to a report from Fuzzy Panda Research accusing the company of fraud.

Zoetis - Shares of the pet medication company sank more than 7% after a Wall Street Journal report looked into potential side effects from its arthritis drugs.

iPhone Shipments Continue to Decline

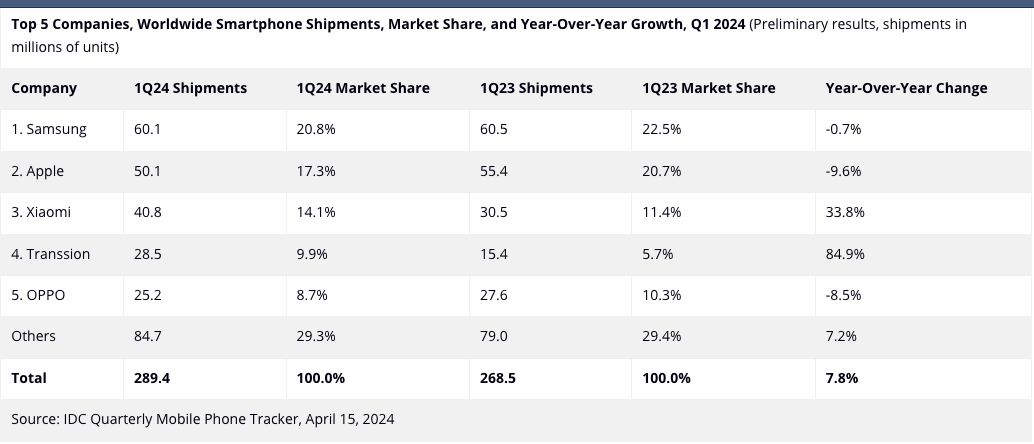

Apple’s iPhone shipments fell close to 10% year over year in Q1 of 2024, as it lost market share to Chinese manufacturers, according to a report from IDC.

The Q1 report stated:

Apple shipped 50.1 million units, down from 55.4 million units last year

Apple recorded the sharpest decline among the top five smartphone brands

Samsung regained the top spot with a market share of 20.8%, shipping 60.1 million units

Apple’s market share fell to 17.3% in Q1 from 20.7% in the year-ago quarter

Xiaomi’s shipments grew by 33.8% to 40.8 million units, while Transsion saw a jump of 84.9% to 28.5 million units

Global smartphone shipments rose 7.8% to 289.4 million units in Q1, recording the third consecutive quarter of growth.

Investors are worried about slowing iPhone sales, as the business accounts for more than 50% of Apple's total revenue. Apple stock has underperformed in 2024, falling almost 5% year-to-date.

Could Oil Prices Soar to $100?

Market analysts expect oil prices to soar past $100 a barrel after Iran mounted an aerial attack on Israel, reigniting fears of escalations in the Middle East.

Source: CNBC

Iran is the third-largest oil producer among OPEC countries, and a disruption in global supply could raise commodity prices.

Additionally, the closure of the Strait of Hormuz, a key chokepoint between Iran and Oman, could mean oil prices may even surpass $120 a barrel, as 20% of global oil flows through the region every day.

The shift towards cleaner energy solutions has meant the oil and gas sector has suffered from underinvestment in recent years while ongoing geopolitical developments have made crude supplies even more vulnerable.

Oil faces a sizeable natural decline in output, as conventional oil wells have a decline rate of 15% if we exclude capital expenditures.

Crypto Experiences a Broader Market Sell-off

The crypto market suffered heavy selling on Saturday, with Bitcoin losing more than 8% following Iran’s attack on Israel.

BTC prices plunged from $70,000 to $62,000 in a couple of hours and have rebounded to trade around $65,000. Other altcoins, such as Solana and Ethereum, also shed more than 10%.

The sell-off for Bitcoin was the steepest in more than a year. Last month, the world’s largest cryptocurrency touched all-time highs amid inflows into spot Bitcoin ETFs.

Headlines You Can't Miss!

China accounted for two-thirds of new global coal plant capacity in 2023

Iranian currency plunges to record low against U.S. dollar

What to expect from Goldman Sachs in Q1 of 2024?

Jamie Dimon warns war, inflation, and Fed policy could most major threats ahead

Hong Kong greenlights spot crypto ETFs

Chart of The Day

Source: Visual Capitalist

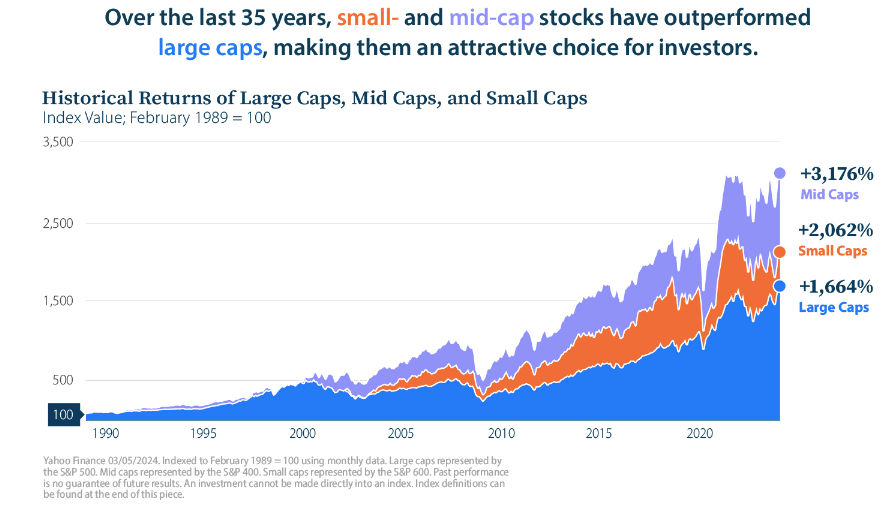

In the last 35 years, small and mid-cap stocks have outperformed large caps. Data from Yahoo Finance suggests between February 1989 and February 2024:

👉 Large cap stocks returned 1,664%

👉 Small-cap stocks returned 2,062% and

👉 Mid-cap stocks returned 3,176%

Typically, mid-caps are well-funded and enjoy stronger balance sheets compared to small-caps, having successfully navigated early-stage growth. Moreover, they are more nimble than large caps and respond quicker to market cycles.

While large caps have underperformed, small and mid-caps came with increased risk due to greater volatility.

It suggests investing in small and mid-caps requires a higher risk tolerance, making these investments ideal for younger investors with longer time horizons.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.